Homeowners insurance can feel overwhelming, especially when you’re buying for the first time or switching providers. Two policies can cost the same but pay out very differently in a claim. Details like deductibles, coverage limits, and add-ons often determine what’s covered and what isn’t.

Here you can get answers to the most common questions about homeowners insurance in plain, clear language, so you can compare options and make decisions with fewer surprises.

Summary

- Cost: Homeowners insurance costs vary widely. Pricing is driven mainly by rebuild cost, deductible, home age/roof condition, claims history, and credit, where allowed.

- Coverage: Most policies cover the home, other structures, personal belongings, liability, and additional living expenses after a covered loss.

- Exclusions: Flood and earthquake usually require separate coverage, and many policies exclude wear and tear, pests, and slow leaks. Water, roof, mold, and foundation claims often depend on a sudden covered event.

1. How much is homeowners insurance?

Homeowners insurance often costs around $1,700–$2,400 per year, but pricing varies widely. Your premium is driven mostly by rebuild cost, location risk, deductible, home condition (especially the roof), and claims history.

2. How much is homeowners insurance per month?

Homeowners insurance often runs about $140–$200 per month on average, but your price depends mainly on rebuild cost, deductible, home condition (especially the roof), and claims history.

Next step: compare quotes using identical coverage limits to see real differences.

3. How much is homeowners insurance on a $400,000 house?

Homeowners insurance is priced on rebuild cost, not your home’s market value. If your home has a $400,000 rebuild amount, insurance often averages about $270–$320 per month (roughly $3,200–$3,800 per year), but pricing varies widely by location, rebuild costs, and insurer.

- Rough Estimate (rule of thumb): Annual premium is often around 0.5%–1.5% of the rebuild amount, but quotes vary widely by insurer and location risk factors. Use this only as a starting point; real pricing comes from quotes.

Next step: use this estimate to set expectations, then confirm with quotes using the same rebuild value.

Example:

$400,000 × 0.8%–1.0% ≈ $3,200–$4,000 per year (before discounts or surcharges)

Key drivers that move the final price include deductible choice, roof age/condition, claims history, and optional coverages like flood or earthquake.

4. How much is homeowners insurance in Texas?

Homeowners insurance in Texas is often above the U.S. average, commonly around $3,000–$4,500 per year or more, largely due to higher storm-related risk and repair costs. Your price depends on local risk level, rebuild cost, roof age/material, deductible, claims history, and insurer pricing.

Next step: compare multiple quotes for your exact address using the same rebuild amount and deductible.

5. How much is homeowners insurance in NJ?

Homeowners insurance in New Jersey often averages about $1,150–$1,500+ per year (roughly $95–$125/month), with wide variation by ZIP code, home age, and reconstruction cost. Inland areas are generally lower, while coastal zones and older homes trend higher due to storm exposure and repair costs.

Premiums also depend on deductible, prior claims, and credit-based rating (where used). Compare quotes across carriers for the most accurate price.

6. Why is my homeowners insurance so high?

Premiums rise when claim losses increase, rebuild costs inflate, and reinsurance gets more expensive. Your price can also increase due to claims history, roof age, coverage upgrades, deductible choices, and credit-based scoring, where allowed.

Ways to save: shop quotes, raise your deductible, bundle policies, and upgrade roof/safety systems.

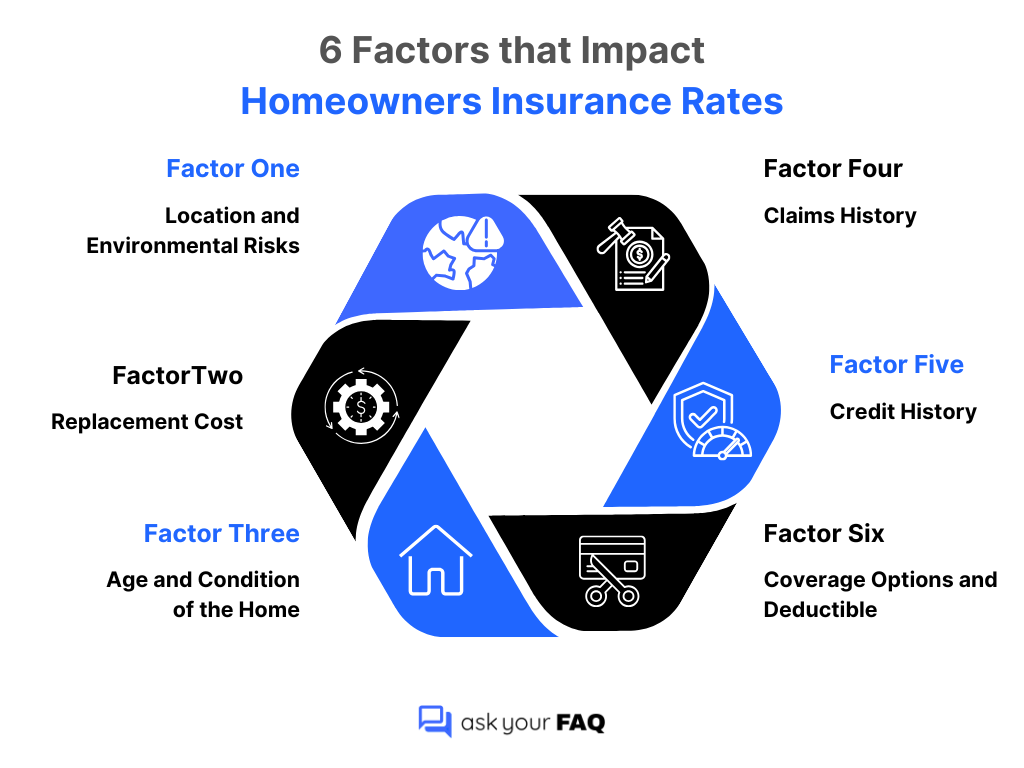

This infographic breaks down the biggest factors that drive homeowners insurance rates, so you can see why your premium might be higher than expected.

7. What does homeowners insurance cover?

Homeowners insurance typically covers the home structure, detached structures (garage, shed, fence), personal belongings, liability, and temporary living costs after a covered loss. Common covered causes include fire, wind, hail, theft, and vandalism, while flood, earthquake, wear and tear, and many sewer backup losses are often excluded unless added.

Policy labels: Coverage A = Dwelling, Coverage B = Other Structures, Coverage C = Personal Property, Coverage D = Loss of Use. Liability is usually Coverage E, and guest medical payments are Coverage F.

8. Is hazard insurance the same thing as homeowners insurance?

Not exactly. Hazard insurance refers to the portion of a homeowners policy that covers damage to the home from specific perils like fire, wind, or hail. Homeowners insurance is broader and also includes personal property, liability coverage, and additional living expenses. Lenders often use “hazard insurance” to mean the property-damage portion they require to protect the home securing the mortgage.

9. What does homeowners insurance not cover?

Homeowners insurance usually doesn’t cover flood, earthquake, landslide/sinkhole movement, or damage from wear, rot, rust, or poor maintenance. It also commonly excludes pest damage (termites/rodents) and many mold situations unless tied to a covered sudden loss.

Sewer/drain backup is often excluded unless added. Coverage for high-value items or home business risks may require endorsements or separate policies. Liability exclusions can apply based on underwriting rules.

10. Does homeowners insurance cover water damage?

Homeowners insurance usually covers sudden, accidental water damage from inside the home, such as a burst pipe, overflow, or an appliance leak (it pays for damaged floors/walls, not the appliance itself).

It typically does not cover flooding (water from the ground), many sewer or sump backups without an add-on, or damage from slow leaks and poor maintenance. Coverage also depends on whether the opening was caused by a covered event.

11. Does homeowners insurance cover roof leaks?

Homeowners insurance may cover roof leaks when the leak is caused by a covered, sudden event, such as wind, hail, fire, lightning, or a falling tree. In those cases, the policy may pay for roof repairs and related interior damage after the deductible.

Leaks caused by wear and tear, aging materials, poor maintenance, or pests are typically excluded. Claims often depend on proving the damage source and documenting the storm or incident.

12. Does homeowners insurance cover water damage from broken pipe?

Homeowners insurance usually covers water damage from a sudden, accidental pipe break, including cleanup and repairs to walls, floors, and damaged belongings. Many policies cover the resulting damage but may not pay to repair the failed pipe itself unless “tear-out” or specific coverage applies.

It typically excludes damage from slow leaks, long-term moisture, neglect, flooding, and many sewer backups or exterior service lines unless you add endorsements. Fast mitigation and documentation support claims.

13. Does homeowners insurance cover pipe replacement?

Homeowners insurance typically covers the resulting water damage from a sudden, accidental pipe burst, such as repairs to walls, floors, and damaged belongings. It usually does not cover replacing old pipes due to wear, corrosion, or gradual leaks, since those are treated as maintenance.

Sewer/drain backups and underground service line failures are often excluded unless you add endorsements. For system repair coverage, a separate home warranty may apply.

14. Does homeowners insurance cover sewer line replacement?

Standard homeowners insurance usually does not cover sewer line replacement because most sewer problems involve wear, corrosion, clogs, or tree roots, issues treated as maintenance. Coverage may apply only in limited cases where a covered event causes direct damage (such as fire, vandalism, or vehicle impact).

For typical sewer line repair and excavation costs, many insurers offer service line coverage as an add-on. Water damage from backups often requires a separate endorsement.

15. Does homeowners insurance cover mold?

Homeowners insurance may cover mold only when it results from a covered, sudden water event, such as a burst pipe or storm damage that creates an opening and leads to interior water intrusion. Mold from slow leaks, humidity, condensation, or lack of maintenance is typically excluded.

Even when covered, many policies apply tight limits to mold cleanup unless you add an endorsement. Flood-related mold is excluded because flood damage requires separate flood insurance.

16. Does homeowners insurance cover termite damage?

Standard homeowners insurance typically does not cover termite damage or termite treatment because it’s considered preventable and develops gradually over time. Policies are built around sudden, accidental losses, not pest-related deterioration.

In some cases, if termites contribute to a separate covered loss, such as damaged wiring leading to a fire, the policy may cover the fire damage, but not the termite damage itself. Prevention and pest contracts are the usual risk management tools.

17. Does homeowners insurance cover a second home or vacation home?

Yes, but second homes usually need their own separate policy. Coverage is similar to a primary-home policy, but premiums can be higher because the home may be vacant more often and may be in higher-risk locations.

If you rent it out or use it as a short-term rental, you may need a landlord or specialty policy, and some insurers restrict coverage based on occupancy and rental activity.

18. Does homeowners insurance cover foundation issues?

Homeowners insurance may cover foundation damage only when a covered, sudden event causes it, such as fire, explosion, vehicle impact, vandalism, or a burst pipe under the slab. It typically does not cover foundation issues from settling, soil movement, poor drainage, faulty construction, long-term leaks, or wear and tear.

Flood and earthquake-related foundation damage usually requires separate policies. Claims are more likely to succeed when you can document a specific incident and timeline.

19. Does homeowners insurance cover roof replacement?

Homeowners insurance may cover roof replacement when damage is caused by a covered, sudden event such as wind, hail, fire, or a falling tree. It typically won’t pay for replacement due to age, wear, poor maintenance, or faulty installation.

Payout depends on your settlement type: replacement cost generally pays more, while actual cash value subtracts depreciation. Your deductible, often higher for wind/hail, also affects what you receive.

20. Does homeowners insurance cover fire?

Homeowners insurance typically covers accidental fire and smoke damage to the home, detached structures, and personal belongings, and it may pay additional living expenses if the home is uninhabitable during repairs.

Coverage can be denied for intentional acts (arson by an insured) and may be limited if the home is vacant beyond the policy’s allowed timeframe. In high wildfire-risk areas, availability, deductibles, or policy terms may differ.

21. Does homeowners insurance cover wildfires?

Most homeowners insurance policies cover wildfire damage because fire is a standard covered peril. Coverage typically includes repairs to the home, replacement of belongings, and additional living expenses if you can’t stay there.

In high-risk wildfire zones, insurers may use higher deductibles, stricter underwriting, reduced options, or non-renewals. If private coverage is limited, some states offer FAIR plans that provide basic fire insurance.

22. Does homeowners insurance cover tornado damage?

Homeowners insurance typically covers tornado-related wind damage to the home, detached structures, and personal property, and may pay additional living expenses if the home is unlivable. Wind-driven rain damage is often covered when the storm creates an opening.

It generally does not cover flood or storm-surge water, which requires separate flood insurance. In some areas, a separate wind/hail deductible (often percentage-based) may apply; check your policy terms.

23. Does homeowners insurance cover theft?

Homeowners insurance typically covers theft of personal property, including items stolen from your home and often away from home (for example, from a car or while traveling), subject to your policy limits and deductible. Payout depends on whether you have actual cash value (depreciated) or replacement cost coverage.

Valuables like jewelry, art, or collectibles often have low sub-limits unless you add scheduled coverage. Damage from a break-in may also be covered.

24. Does homeowners insurance cover dog bites?

Homeowners insurance often covers dog bites under personal liability, which can pay medical costs, legal defense, and settlements if you’re legally responsible. Coverage can be restricted based on underwriting rules; some insurers limit or exclude certain dogs due to prior bite history, training/use, or non-disclosure, and rules vary by state and carrier.

Liability limits may be too low for severe injuries, so some homeowners increase limits or add an umbrella policy for extra protection.

25. Does homeowners insurance cover tree removal?

Homeowners insurance may cover tree removal when a tree falls due to a covered event (wind, lightning, ice) and damages a covered structure or blocks a driveway/accessible entrance. Coverage is often limited per tree and may include debris removal.

It usually won’t pay for preventive removal or for a fallen tree that causes no damage. If the tree was clearly hazardous and ignored, claim outcomes can be affected depending on policy terms.

26. Does homeowners insurance cover fences?

Homeowners insurance often covers fence damage under the other structures portion of the policy when it’s caused by a covered, sudden event such as wind, hail, fire, vandalism, or vehicle impact.

Payment is subject to your deductible and the policy’s limit for detached structures, and it may settle at depreciated value unless replacement-cost coverage applies. It typically excludes wear and tear, rot, termites, and flooding without separate flood coverage.

27. Does homeowners insurance cover storage units?

Homeowners insurance often covers belongings in a storage unit under off-premises personal property coverage, usually for perils like fire, theft, and vandalism. The payout is typically capped at a percentage of your total personal property limit and is subject to your deductible.

Flood and earthquake losses are commonly excluded unless separately insured. High-value items (jewelry, art, collectibles) may have low sub-limits unless scheduled, so check limits before relying on them.

28. Is homeowners insurance included in mortgage?

Homeowners insurance is separate from your mortgage, but many lenders collect it through an escrow account and include it in your monthly payment (often shown as part of PITI: principal, interest, taxes, insurance).

The lender holds those funds and pays the insurance bill when due. Some borrowers can pay the insurer directly if escrow is waived, but the lender still requires proof of an active policy to protect the property securing the loan.

29. Is homeowners insurance tax deductible?

Homeowners insurance premiums are generally not tax-deductible for a primary personal residence. Exceptions may apply when the property is used to produce income, such as rental property (premium is typically deductible as an expense) or self-employment home office use (a prorated share may be deductible when the space is used regularly and exclusively).

In some cases, uninsured losses from a federally declared disaster may qualify for a casualty loss deduction. Tax rules vary, so confirm with a tax professional.

30. How does homeowners insurance work?

You pay a premium for coverage against listed perils. If a covered loss occurs, you file a claim, pay your deductible, and the insurer pays covered repairs or replacement up to your policy limits.

Next step: confirm your rebuild amount and whether your policy pays replacement cost on the structure and belongings.

31. How to choose homeowners insurance?

Start with rebuild cost (Coverage A), then choose liability coverage, then add endorsements to fill key gaps. The biggest differences between policies are often exclusions, deductibles, and whether claims pay replacement cost or depreciated value.

Next step: compare quotes using the same rebuild amount, deductible, and add-ons to avoid apples-to-oranges pricing.

32. How to calculate homeowners insurance?

To estimate homeowners insurance, start with your rebuild cost (Coverage A), since it drives most of the premium. Pricing then shifts based on location risk factors, deductible, roof/home condition, claims history, and coverage add-ons.

Next step: confirm your rebuild estimate and get quotes using the same Coverage A and deductible.

33. How to change homeowners insurance?

You can change homeowners insurance by switching to a new policy with the same rebuild amount and key endorsements, then canceling the old policy only after the new one is active. The main risk is a coverage gap or lost endorsements.

Next step: bind the new policy first and send the declarations page to your lender/escrow.

34. Can you change homeowners insurance at any time?

Yes, you can change homeowners insurance at any time, even mid-policy. The key trade-offs are possible cancellation fees and the risk of a coverage gap. Next step: bind the new policy first, match effective dates, and notify your lender/escrow so that billing updates correctly.

Related Reads

Auto Insurance FAQ: Your Complete Guide to Coverage, Claims & Costs

Travel Insurance FAQ: What Coverage Do You Really Need Before Your Trip?