Investing in mutual funds is one of the most effective ways to build long-term wealth, but it often raises essential questions. With countless fund types, strategies, and market dynamics to consider, identifying the right approach can feel complex.

The key to success lies not in following trends, but in asking the right questions and making informed decisions.

From taking your first steps, understanding rules and principles, and evaluating fund performance, this guide addresses the essentials every investor should know. It also explores innovative strategies and retirement planning, providing clear answers that support confident and well-informed investing.

With that foundation in place, let’s proceed directly to the key questions and answers that every investor should consider before making informed mutual fund decisions.

Beginner Guidance & First Investments

The first hurdle for most investors is knowing where and how to begin. Here’s exactly what you need to make your first mutual fund investment with confidence.

1. What’s the minimum amount needed to start investing in mutual funds?

Most mutual funds allow you to start with as little as $500–$3,000, while SIPs can begin at $50–$100 monthly. The low entry barrier makes mutual funds accessible to beginners, allowing you to build wealth consistently without requiring a significant upfront investment.

2. How should a beginner decide between equity funds, debt funds, or balanced funds?

| Fund Type | Best For | Risk Level | Returns Potential | Beginner Tip |

| Equity Funds | Long-term growth (5+ years) | High | High (beats inflation) | Choose this option only if you are comfortable with volatility and have a longer investment horizon. |

| Debt Funds | Short-term stability & safety (1–3 yrs) | Low | Moderate (better than savings accounts) | Suitable for conservative beginners or as an emergency fund. |

| Balanced Funds | Mix of growth and safety (3–5 years) | Medium | Moderate–High | Ideal for beginners unsure where to start. Offers diversification automatically. |

| Index Funds | Simple, low-cost long-term investing | Medium–High | Market-matching | Great beginner option for steady, passive investing. |

3. What’s the difference between an actively managed fund and an index fund?

| Feature | Actively Managed Fund | Index Fund |

| Management Style | A professional manager selects securities to beat the market. | Passively tracks a market index (e.g., S&P 500). |

| Costs/Fees | Higher (due to active research & management). | Lower (minimal management). |

| Performance Goal | Outperform the benchmark. | Match the benchmark. |

| Risk Factor | Higher, depending on the manager’s decisions. | Lower, tied to the overall market. |

| Best For | Investors seeking potential outperformance and willing to pay higher fees. | Beginners and long-term investors want simplicity, low cost, and reliable market exposure. |

4. How can a new investor assess whether a fund aligns with their financial goals?

Check if the fund’s goal, risk profile, and asset mix match your own. For short-term goals, look at debt or hybrid funds that offer more stability. For long-term goals, equity or index funds may suit you better. Make sure the time you plan to stay invested lines up with the fund’s suggested horizon to avoid surprises.

5. What’s the simplest way to track mutual fund performance over time?

- Check the fund’s NAV (Net Asset Value) regularly to see price movements.

- Review annualized returns over 1, 3, and 5 years for consistency.

- Compare performance against the benchmark index and category peers.

- Use trusted financial apps or the fund provider’s online dashboard for secure access.

- Set quarterly or yearly reviews instead of daily tracking to stay focused on long-term goals.

6. Should a first-time investor start with a Systematic Investment Plan (SIP) or a lump sum?

SIPs are ideal for beginners because they spread investments over time, reduce market timing risk, and build disciplined saving habits. Lump sums are suitable for those with larger surplus funds and strong market knowledge. For most first-timers, SIPs offer safer, steadier growth.

Now that you know how to begin, it’s time to understand the core rules and principles that guide smart investing.

Rules, Principles, & Investment Wisdom

Many investors make mistakes by chasing quick gains or ignoring basic principles. Knowing the rules and proven wisdom behind mutual funds helps you avoid costly errors and build confidence in every decision.

7. What regulatory protections exist for mutual fund investors?

Government bodies, such as the SEC in the U.S. or SEBI in India, regulate mutual funds. Rules ensure transparency, mandatory disclosures, independent trustees, and audits. These protections safeguard investors against fraud while requiring funds to publish NAVs and performance regularly.

8. How often should investors review their mutual fund portfolio?

Reviewing your portfolio once or twice a year is usually sufficient. This helps you check performance against benchmarks, ensure your funds still align with your goals, and rebalance if allocations drift. Avoid frequent reviews, as reacting to short-term market movements can lead to poor decisions.

9. Why is diversification considered a core principle of mutual fund investing?

Diversification spreads money across many securities, reducing the risk of loss from any single stock or bond. Mutual funds automatically diversify your investment, balancing winners and losers. This principle protects against volatility and enhances the likelihood of steady, long-term returns.

10. What are the risks of chasing past performance in mutual funds?

- No guarantees: Past performance does not predict future returns.

- Market cycles: A fund leading today may lag tomorrow when conditions shift.

- Management changes: New managers can alter strategy, which can impact results.

- Behavioral trap: Investors often buy high (after strong returns) and sell low (during downturns).

- Better approach: Focus on consistency, long-term strategy, and alignment with personal goals.

11. How do market cycles influence the performance of different types of funds?

Equity funds tend to thrive in bull markets but often experience downturns during bear markets. Debt funds offer stability in volatile markets but tend to underperform during strong equity rallies. Balanced funds smooth out these cycles. Understanding market phases helps set realistic expectations and reduces emotional decision-making.

12. What role should mutual funds play in a balanced portfolio compared to other asset classes?

Mutual funds offer diversification, liquidity, and professional management, making them a vital component of a well-diversified and balanced portfolio. They complement other assets, such as stocks, bonds, or real estate. The exact allocation depends on your goals, risk tolerance, and investment horizon.

With the core principles in place, the next step is to learn how to select the right funds and measure their performance effectively.

Performance & Fund Selection

One of the biggest struggles for investors is choosing the right fund. With numerous options available, knowing how to measure performance and make informed decisions is crucial for avoiding costly mistakes.

13. What are the key metrics to evaluate before selecting a mutual fund (e.g., alpha, beta, Sharpe ratio)?

Key metrics include alpha (excess return over the benchmark), beta (volatility relative to the market), Sharpe ratio (risk-adjusted return), expense ratio, and consistency of returns. Together, they reveal whether a fund delivers value for the risk it undertakes, helping investors make more informed choices.

14. How should an investor compare funds within the same category?

Compare long-term performance (3-10 years), expense ratios, fund manager track record, and portfolio diversification. Check how consistently the fund beats its benchmark and peers. Avoid chasing short-term spikes; instead, focus on steady returns that align with your risk profile and goals.

15. What does the fund manager’s track record reveal about future performance potential?

A skilled and experienced manager with consistent results across market cycles demonstrates discipline and strong decision-making. However, don’t rely only on reputation, fund strategy, team support, and adherence to investment style; these factors matter equally. A good track record builds confidence, but isn’t a guarantee.

16. How important is a fund’s size (AUM) when considering it for investment?

AUM (Assets Under Management) reflects investor trust and the stability of the fund. Minimal funds may face liquidity issues, while substantial funds can struggle with agility. Mid- to large-sized funds with steady inflows generally strike the right balance between stability and flexibility.

17. Should investors prioritize funds with consistent returns or those with high peak performance?

Consistent returns are more valuable than short bursts of outperformance. High peaks usually involve higher risk and potential sharp declines. Funds that deliver steady, benchmark-beating returns across cycles better protect wealth and help investors stay invested without emotional stress.

18. How does benchmark comparison help in evaluating a fund’s success?

Benchmarks set the standard for measuring performance. A fund consistently outperforming its benchmark proves its strategy and management add value. If it regularly lags, it’s better to choose a low-cost index fund. Benchmarks keep fund performance in perspective.

Once you know how to evaluate and select the right funds, the next step is understanding the methods and strategies that make your investments work smarter over time.

Investment Methods & Strategies

Many investors pick good funds but still fall short because they lack a precise investment method. Knowing when, how, and how much to invest is just as important as fund selection for building lasting wealth.

19. When should an investor prefer active funds over passive funds?

Choose active funds when markets are inefficient, niches are specialized, or you want a skilled manager exploiting opportunities. In highly efficient markets, such as U.S. large-cap equities, passive index funds often outperform after accounting for fees and expenses. Active funds are suitable for investors seeking tactical advantages.

20. How does dollar-cost averaging through SIPs reduce risk?

Dollar-cost averaging through SIPs means investing a fixed amount at regular intervals, no matter how the market moves. It helps you buy more units when prices are low and fewer when they’re high, averaging out your cost over time. This strategy removes the stress of market timing, builds consistency, and supports long-term wealth growth with reduced volatility.

21. What’s the best strategy for rebalancing a mutual fund portfolio?

Rebalance your portfolio once a year or when your asset allocation shifts 5-10% from your set targets. This means trimming gains from funds that have grown too large and adding to those that lag. It keeps your risk level steady, avoids taking on too much in one area, and helps you stay on track with your long-term investment strategy.

22. Should investors use mutual funds for short-term goals, or are they best for long-term horizons?

Mutual funds are ideal for long-term goals like retirement, buying a house, or building wealth. Equity funds, in particular, need time to grow and smooth out market ups and downs. For short-term needs, debt or liquid funds are better suited, offering stability and lower risk without the pressure of unpredictable equity market movements.

23. How do tax-efficient mutual fund strategies impact net returns?

Tax efficiency directly boosts take-home returns. Holding equity funds for over a year qualifies for lower capital gains tax. Using index funds, ELSS (in India), or retirement accounts helps minimize tax drag. Over decades, small tax savings compound into big gains, making tax-smart investing just as important as picking the right fund.

24. Is it better to diversify across multiple fund houses or stick with a few trusted ones?

Diversify across a few reliable fund houses, but avoid spreading too thin. A handful of strong providers ensures professional stability, consistency, and manageable tracking. Too many fund houses complicate oversight without a meaningful added benefit. The quality of management matters more than the quantity.

After mastering the right methods and strategies, the next focus is on using mutual funds to build lasting wealth and prepare confidently for retirement.

Long-Term Wealth Building & Retirement Planning

Short-term gains may feel rewarding, but proper financial security comes from building long-term wealth. Mutual funds can help you plan confidently for retirement and protect your future.

25. How do mutual funds compare to retirement-specific accounts (like IRAs or 401(k)s)?

Mutual funds are investment vehicles, while IRAs and 401(k)s are tax-advantaged retirement accounts that can hold mutual funds. Retirement accounts offer tax benefits, while funds provide diversification and potential for growth. Ideally, combine both by investing in mutual funds through these retirement accounts.

26. What type of mutual funds are best suited for retirement planning?

Choosing the correct type of fund is only one step; understanding how compounding works over decades is equally critical for achieving retirement success.

- Equity-Oriented Funds: Provide strong long-term growth and consistently beat inflation, making them powerful wealth-builders for retirement.

- Target-Date Funds: Adjust automatically from equities to safer debt instruments as retirement approaches, offering convenience and reduced risk.

- Key Consideration: The right mix depends on age, time horizon, and risk tolerance.

27. How does compounding work when investing through SIPs over decades?

Compounding multiplies your returns by reinvesting earnings over time, thereby increasing your overall returns. For example, investing $200 monthly for 30 years at a 10% annual return grows to nearly $400,000. The earlier you start, the greater the snowball effect. Time is your most powerful wealth-building tool.

28. Should retirement investors adjust their fund allocation as they approach retirement age?

Yes. As retirement nears, gradually shift from high-risk equity funds to safer debt or balanced funds. This strategy, known as a “glide path,” protects accumulated wealth while still generating moderate growth. Preserving capital becomes more important than chasing maximum returns in later years.

29. How can mutual funds hedge against inflation in the long run?

Equity mutual funds generally outperform inflation by delivering higher long-term returns than fixed deposits or bonds. Diversified equity funds, particularly those focusing on growth sectors, are effective inflation hedges. By holding them for decades, investors ensure their purchasing power doesn’t erode.

30. What role do target-date or life-cycle funds play in retirement planning?

Target-date funds automatically rebalance investments from aggressive equities to conservative debt as retirement approaches. This “set-and-forget” option simplifies planning and reduces the need for emotional decision-making. Life-cycle funds are suitable for investors who want convenience and automatic risk adjustment without actively managing their portfolio.

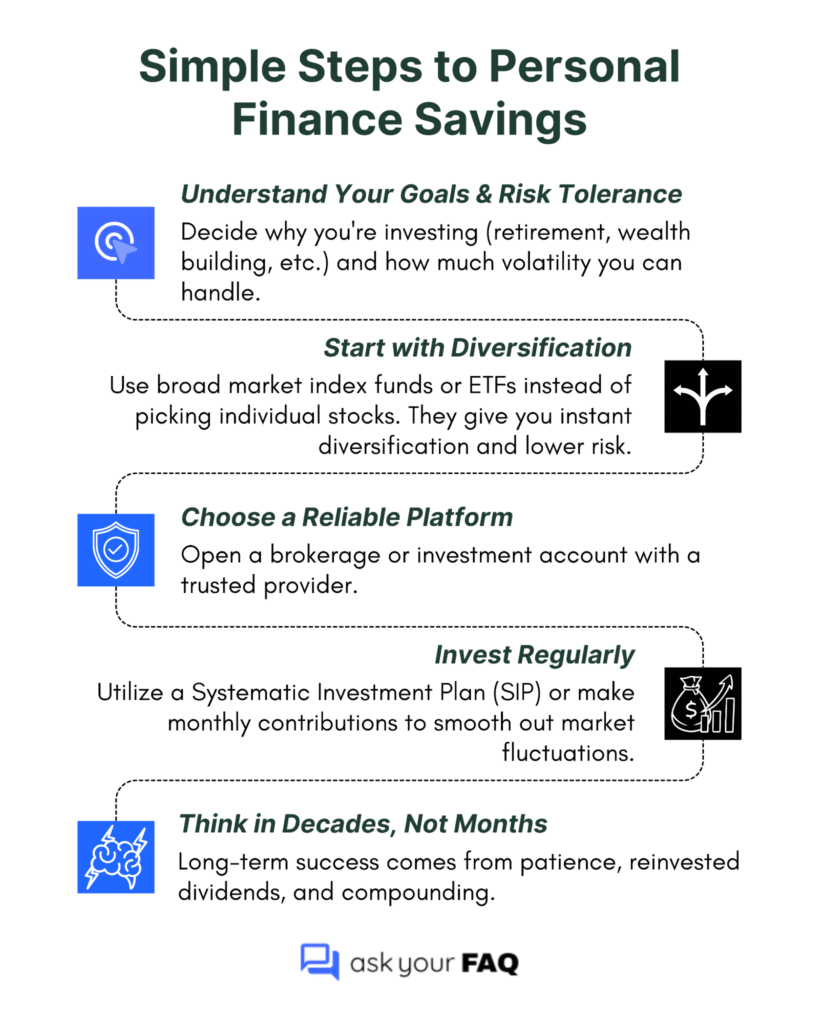

31. Where to start for long-term stock investing?

Successful long-term stock investing begins with understanding your goals and risk tolerance, diversifying through index or equity funds, selecting a reliable platform, investing regularly, and maintaining a long-term perspective to fully benefit from compounding growth. Avoid frequent buying and selling; staying invested over time is where real gains tend to happen.

Risk Management & Investor Behavior

Building long-term wealth is powerful, but it’s equally important to manage risks and control investor behavior. The way you respond to market swings often decides your real success.

32. How should investors manage market volatility without succumbing to panic selling?

Focus on long-term goals, not short-term noise. Volatility is expected in markets. Stay disciplined with SIPs, avoid reacting to daily news, and review fundamentals instead. Having an emergency fund helps reduce the urge to withdraw investments in downturns. Consistency and patience matter more than timing the market or chasing short-term gains.

33. What’s the role of an emergency fund before starting mutual fund investing?

An emergency fund of 3-6 months’ expenses ensures liquidity during crises. It prevents the premature redemption of mutual funds, especially equity funds, which can hinder long-term growth. Building this safety net first makes you a more confident, patient investor. It also helps you stay invested during market dips, without compromising your long-term financial goals.

34. How can investors avoid common behavioral pitfalls, such as overconfidence or herd mentality?

Set clear goals, follow a written plan, and review periodically instead of reacting emotionally. Avoid chasing “hot funds” or following crowds. Discipline, patience, and sticking to asset allocation prevent costly mistakes. Staying invested through market cycles, learning from past behavior, and seeking professional advice when needed, helps you stay on track and avoid common investor pitfalls.

35. What’s the right way to set realistic return expectations?

Expect average equity returns of 8-10% annually over the long term, not overnight wealth. Debt funds generally deliver 4-6%. Setting realistic expectations prevents disappointment and reckless decisions. Investing works best when patience and discipline outweigh chasing unrealistic numbers. Focus on steady growth, avoid market noise, and stick to your plan even during market ups and downs.

Your Complete Mutual Funds FAQ Guide to Smarter Investing

Investing in mutual funds is not just about choosing the right product; it’s about building a disciplined approach that aligns with your goals, risk tolerance, and plans. By starting small, adhering to core principles, evaluating performance effectively, and implementing innovative strategies, you can steadily build wealth and lay the groundwork for long-term financial security.

Retirement planning and risk management further ensure that your investments remain resilient throughout market cycles. By focusing on these safeguards, you reduce the risk of financial setbacks that could otherwise push investors toward debt or even bankruptcy. The key to success is patience, consistency, and informed decision-making. With these insights, you’re equipped to invest confidently, avoid common pitfalls, and make mutual funds a powerful tool for financial freedom.