You’ve just purchased a new car and arranged the insurance to protect it. After comparing quotes and selecting a policy, you feel confident you’ve made the right choice. Fast forward to renewal time, and your premium is higher. No accidents, no tickets, no changes to your driving habits, yet the cost has gone up.

It’s a situation many policyholders face, often without a clear explanation. Market trends, insurer adjustments, and other factors beyond your control can all play a role.

This car insurance FAQ blog compiles 40 key questions to explain what affects your premium, protect your assets, and keep your coverage right for you.

Choosing & Securing Insurance

Getting car insurance is the first step to protecting yourself and your vehicle. The way you choose and secure a policy determines how well you’re covered from day one and how smoothly your protection holds up over time.

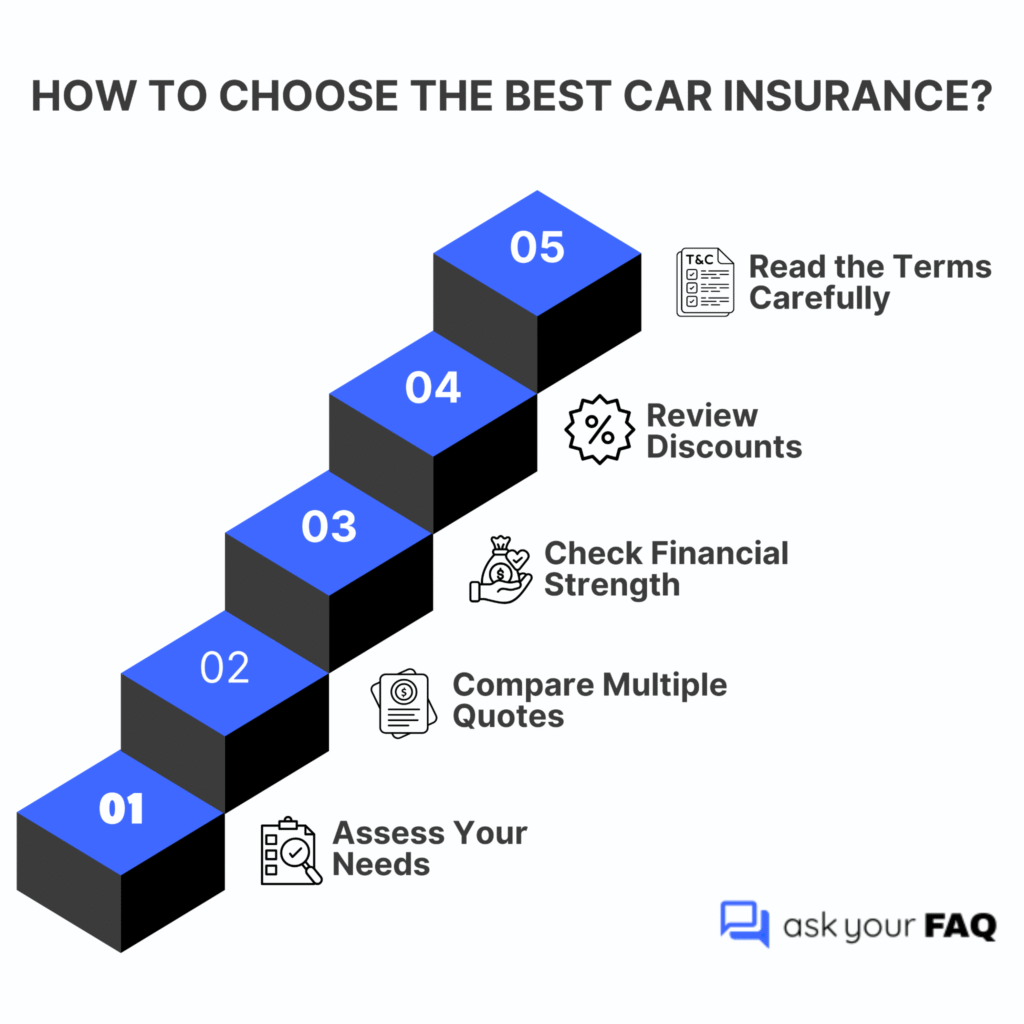

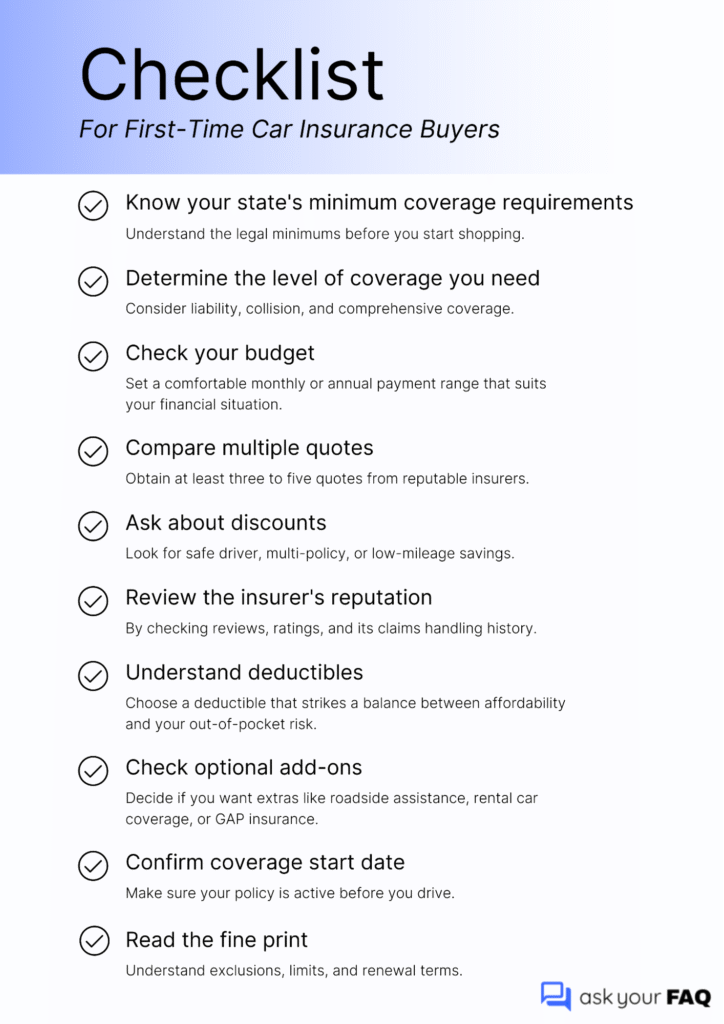

1. How to choose the best car insurance?

To choose the best car insurance, assess your coverage needs, compare multiple quotes, verify insurer financial strength, look for available discounts, and carefully read the terms and conditions to ensure the policy truly fits your requirements.

2. What should I look for when comparing car insurance policies?

Compare coverage limits, deductibles, and exclusions side by side to find the best fit for your needs. Check included benefits or add-ons, and ensure you’re not paying extra for features you don’t need.

3. How can I determine if an insurer is financially stable?

To determine if an insurer is financially stable, check independent financial ratings, review their claim settlement history, and evaluate customer feedback to gauge reliability, payment consistency, and overall service quality.

4. Is it better to buy car insurance online or through an agent?

Buying car insurance online is usually faster and may offer lower rates, while agents provide personalized guidance and support. The better option depends on whether you prefer independent research or tailored assistance during the decision-making process.

5. What’s the difference between an insurance quote and a policy?

An insurance quote is a non-binding estimate of your premium based on provided details, while a policy is the official, legally binding contract that takes effect once you accept the terms and make the required payment.

6. How quickly should I secure insurance after buying a car?

You should arrange car insurance before driving your new vehicle, as most states require proof of coverage to operate legally. Securing it in advance ensures you’re fully protected from the moment you take ownership, avoiding potential legal issues or uncovered accidents.

Next, let’s understand the factors that determine your car insurance cost.

Cost & Pricing Factors

Not all car insurance is the same. Each type of coverage serves a different purpose, from protecting others in an accident to covering your own losses. Knowing these terms helps you choose the right mix of protection for your situation.

7. Why does my premium increase even without claims or changes to my driving habits?

Your premium may increase due to market trends, inflation, higher repair costs, and company-wide rate adjustments, even if you haven’t made claims or changed your driving habits, as these factors influence overall insurance pricing.

8. How do insurers calculate car insurance premiums?

Insurers calculate car insurance premiums by assessing various factors, including driving history, location, vehicle type, coverage level, credit score, and past claims, to determine your overall risk and set an appropriate rate.

9. What external factors can cause insurance rates to rise nationwide?

Nationwide insurance rates can rise due to factors such as natural disasters, inflation, increased accident frequency, higher medical costs, and rising vehicle repair expenses, all of which increase insurers’ overall claim payouts and operational expenses.

10. Does where I live affect the cost of my insurance?

Yes. Living in areas with higher accident rates, theft incidents, severe weather, or crime typically results in higher premiums, as insurers view these locations as posing a greater overall risk for potential claims.

11. How does inflation impact my car insurance cost?

Inflation raises the cost of vehicle repairs, medical treatment, and replacements, prompting insurers to increase premiums so they can cover the higher expenses associated with potential claims.

With costs covered, let’s look at the main types of car insurance and what each includes.

Insurance Coverage Types & Terms

Car insurance is made up of different coverage types, each designed to protect you in specific situations. Understanding how liability, collision, comprehensive, and other options work helps you build a policy that fits your needs.

12. What’s the difference between liability, collision, and comprehensive coverage?

| Coverage Type | What It Covers | When It Applies |

| Liability | Injuries and property damage you cause to others. | When you’re at fault in an accident. |

| Collision | Damage to your car from collisions with vehicles or objects. | When your car hits another vehicle or object. |

| Comprehensive | Non-collision damage such as theft, vandalism, fire, or weather. | Events like storms, theft, falling objects, or animal strikes. |

13. What is uninsured/underinsured motorist coverage, and do I need it?

| Coverage Type | What It Covers | When It Applies | Why It’s Important |

| Uninsured/Underinsured Motorist | Your medical expenses, lost wages, and sometimes vehicle damage. | When the at-fault driver has no insurance or insufficient coverage. | Protects you from paying out-of-pocket after such accidents. |

14. How does GAP insurance work?

GAP insurance covers the difference between your car’s loan or lease balance and its current market value if it’s totaled or stolen, ensuring you’re not left paying for a vehicle you no longer have.

15. What does “full coverage” really mean?

“Full coverage” generally refers to having liability, collision, and comprehensive insurance together. It doesn’t cover every possible event, but provides broad protection for both your vehicle and the damages you may cause to others.

16. What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out of pocket before insurance covers a claim. Choosing a higher deductible lowers your premium but increases your costs if you need to file a claim.

Once you know what affects your cost, the next step is deciding how much coverage is right for you.

Coverage Level Decisions

The right amount of coverage depends on your car’s value, your budget, and how much risk you’re willing to take. Deciding between minimum protection and broader coverage ensures you balance affordability with financial security.

17. How much car insurance coverage do I need?

You should carry at least your state’s minimum required liability coverage, but often more for better protection, especially if you want to avoid financial strain that could even lead to bankruptcy after a serious accident.

Consider your vehicle’s value, driving habits, and personal assets. Higher limits and optional coverages like comprehensive, collision, and uninsured motorist can protect against costly repairs, lawsuits, and medical expenses that exceed minimum limits.

18. Should I choose a higher deductible to lower my premium?

If you choose a higher deductible, you’ll likely pay less each month for your premium, but you’ll owe more out of pocket if you file a claim. This approach works well if you have a clean driving record, rarely make claims, and can afford the deductible amount in case of an accident. It’s a trade-off between saving now and potential future expenses.

19. How do I decide between minimum and comprehensive coverage?

If your car’s value is low and keeping costs down is your main goal, minimum coverage may be enough. But if you own a newer or high-value vehicle, comprehensive coverage offers broader protection against accidents, theft, and non-collision damage, giving you greater financial security.

20. Does the value of my car determine my coverage needs?

Yes. If your car is high in value, it’s wise to have comprehensive and collision coverage to protect your investment. For older or lower-value cars, liability coverage may be sufficient, since repair or replacement costs are lower.

21. When should I consider reducing coverage on an older car?

You should consider reducing coverage on an older car when the combined cost of your annual premium and deductible is close to or greater than the vehicle’s market value, as the payout after a claim may not justify the expense.

After deciding your coverage level, the next step is finding ways to lower your premium.

Discounts, Savings & Lowering Premiums

Car insurance can be expensive, but there are ways to bring costs down. Taking advantage of discounts, smart payment choices, and safe driving habits helps you keep premiums low without sacrificing protection.

22. What are the common discounts available for car insurance?

It includes safe driver rewards for accident-free records, multi-policy and multi-car savings, good student discounts, reduced rates for completing defensive driving courses, and lower premiums for installing anti-theft devices that reduce theft risk.

23. Can paying my premium annually instead of monthly save money?

Yes. Many insurers charge extra fees for monthly payments. Paying annually avoids installment charges, often leading to noticeable savings over the life of your policy.

24. Does installing anti-theft devices in my car reduce my premium?

Yes. It can lower your premium because anti-theft devices reduce the likelihood of your car being stolen or damaged, which decreases the insurer’s risk and can qualify you for a security-related discount.

25. Will taking a defensive driving course lower my rates?

Yes. It can lower your rates because it demonstrates you’re actively reducing accident risk, making you a safer driver in the insurer’s eyes and often qualifying you for a policy discount.

26. How can I keep my premium low over time?

To keep your premium low over time, maintain a clean driving record, and compare quotes, similar to how shopping around helps you secure the best personal loan rate.

Once you’ve explored ways to save, it’s important to understand the legal requirements that apply to your coverage.

Legal & Regulatory Questions

Car insurance requirements aren’t the same everywhere. Each state sets its own rules on minimum coverage and liability, making it important to understand the laws where you drive to stay compliant and avoid penalties.

27. Is car insurance mandatory in every state?

Car insurance is required in almost every state, but minimum coverage requirements vary. New Hampshire and Virginia allow certain exceptions, though drivers there must still prove they can cover costs if involved in an accident.

28. What’s the minimum legal coverage I need in my state?

It depends on your state’s laws, typically set as liability limits for bodily injury per person, bodily injury per accident, and property damage, ensuring you can cover costs if you cause an accident.

29. Can I legally drive someone else’s car with my insurance?

You can usually drive someone else’s car with your insurance, but coverage depends on the policy terms. In most cases, the car owner’s insurance is primary, and yours may offer secondary protection if needed.

30. What’s the difference between no-fault and at-fault insurance states?

| System | How It Works | Who Pays After an Accident |

| No-Fault State | Each driver’s own insurance covers their medical expenses, regardless of fault. | Your insurer pays your medical costs. |

| At-Fault State | The driver who caused the accident is responsible for the damages and injuries. | The at-fault driver’s insurer pays for others’ expenses. |

31. What happens if I’m caught driving without insurance?

Driving without insurance can lead to serious consequences, including:

- Fines that vary by state and offense severity.

- License and registration suspension until proof of insurance is provided.

- Vehicle impoundment, requiring payment of fees to retrieve it.

- Higher future premiums due to increased risk classification.

- Court penalties or jail time for repeat or severe violations.

Once you understand the legal requirements, you must learn how to change or switch your policy when needed.

Policy Changes & Switching

Your insurance needs can change over time. Knowing when and how to adjust your coverage or switch providers helps you avoid gaps, manage costs, and keep your policy aligned with your situation.

32. Can I change my coverage level during the policy term?

You can usually change your coverage level during the policy term, and most insurers allow it at any time. However, adjustments may take effect immediately and could increase or decrease your premium based on the changes you make.

32. What’s the best time to switch car insurance providers?

The best time to switch car insurance providers is at policy renewal or right after a significant rate increase. However, you can switch anytime if the potential savings outweigh any cancellation fees or loss of discounts.

33. Are there penalties for canceling my policy early?

Canceling your policy early can sometimes result in a small cancellation fee, loss of unused discounts, or a short-rate penalty. Always review your policy terms to understand any costs before ending coverage mid-term.

34. How do I transfer my insurance to a new vehicle?

To transfer your insurance to a new vehicle:

- Contact your insurer promptly after purchasing the car.

- Provide vehicle details such as make, model, year, and VIN.

- Review updated coverage and premium changes.

- Confirm the start date so coverage begins when you take ownership.

35. Will switching insurers affect my driving record or coverage history?

Switching insurers won’t affect your driving record, as that’s maintained by state authorities. However, any gaps in coverage can raise future premiums, so ensure your new policy starts before your old one ends.

Once you’ve handled policy changes, be prepared for how accidents and claims can impact your driving record.

Claims, Accidents & Driving Record

Filing a claim or getting into an accident can raise your costs and affect your insurance history. Understanding how the process works and how long incidents stay on your record helps you manage both coverage and expenses.

36. How do I file a car insurance claim?

To file a car insurance claim:

- Contact your insurer as soon as possible after the incident.

- Provide details about the accident, including time, location, and parties involved.

- Submit evidence such as photos, videos, or witness statements.

- Include a police report if applicable.

- Follow the insurer’s process for inspections, repairs, and settlement.

37. How does an accident affect my premium?

Of course, particularly if you’re found at fault. The increase depends on factors like accident severity, claim amount, your past driving record, and whether you have accident forgiveness on your policy.

38. What happens if I’m in an accident with an uninsured driver?

If you’re in an accident with an uninsured driver, your uninsured motorist coverage, if included in your policy, can pay for medical expenses, lost wages, and sometimes vehicle repairs, protecting you from covering these costs yourself.

39. How long do accidents stay on my insurance record?

Accidents generally stay on your insurance record for three to five years, though the exact duration depends on your state’s regulations, the insurer’s policies, and the severity or type of accident involved.

40. Will a small claim always result in a rate increase?

A small claim doesn’t always cause a rate increase, but it can if it adds to a history of frequent claims. Insurers often see multiple claims as higher risk, which can raise your premiums.

Your Go-To Car Insurance FAQ for Smarter Coverage Decisions

Understanding the details behind your coverage can help you make confident, cost-effective decisions about your policy. These car insurance FAQs address the most common questions drivers face, from choosing the right insurer to managing costs and handling claims.

By knowing how premiums are calculated, which coverages suit your needs, and when to adjust your policy, you can protect your assets while avoiding unnecessary expenses.

Remember, insurance is more than a legal requirement; it’s a financial safety net. Keep this blog to revisit key points, compare options, and ensure your coverage remains the right fit as your driving situation changes.