Business insurance rarely comes down to a single policy or price. Premiums reflect assessed exposure, coverage sets the edges of protection, and requirements are shaped by business structure, location, and the contracts a company signs.

For owners and operators, the challenge is not finding insurance; it’s understanding what is standard, what is conditional, and what changes as a business grows or takes on new work.

This blog breaks down the core policy types, the cost drivers behind them, and the compliance or contractual triggers that make certain coverages necessary, without assuming one business model or outcome.

Summary

- Explains how business insurance costs, coverage, and requirements differ across industries and business structures, including what drives premiums and how pricing reflects exposure.

- Breaks down how common policies work in practice, what they cover, key limits, exclusions, and where coverage boundaries are set.

- Clarifies when insurance is required by law or contract, how risk changes by operation type, and how to evaluate coverage decisions using consistent criteria.

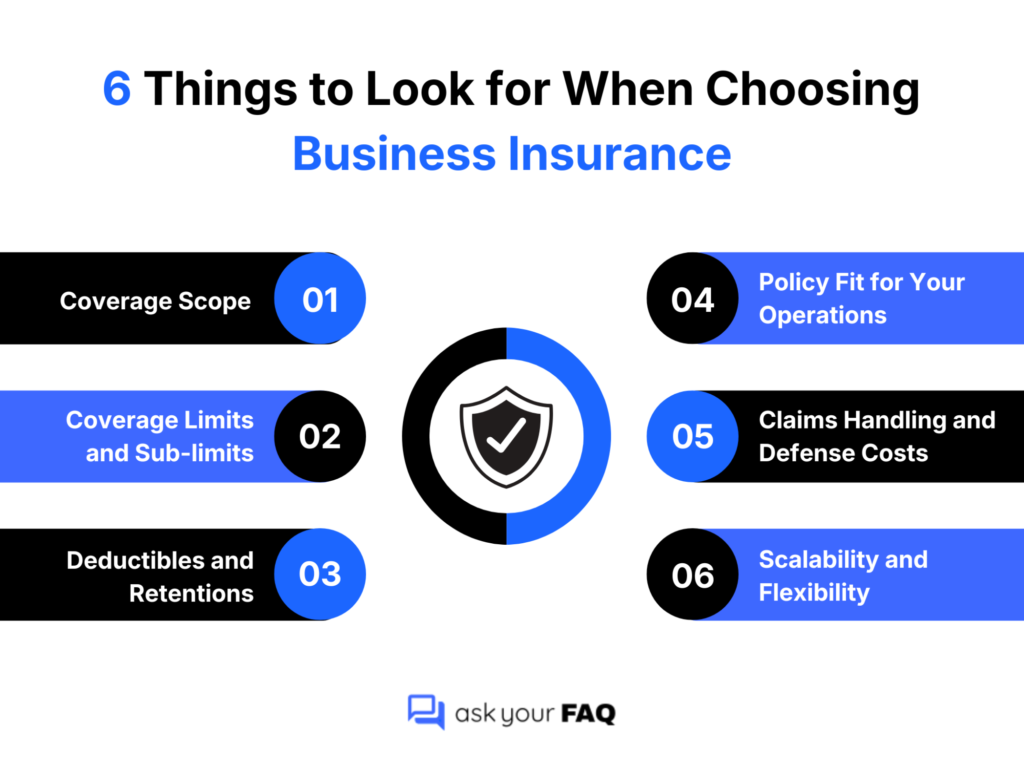

6 Things to Look for When Choosing Business Insurance

Before you compare quotes, review how coverage is structured. The checklist below summarizes the six areas that most directly affect protection, cost, and how a policy performs in real claims.

With these criteria in mind, the FAQs below break down costs, coverage, requirements, and how common business insurance policies work in practice.

1. How much is business insurance?

Business insurance can cost anywhere from a few hundred to several thousand dollars a year. Most small businesses spend around $600–$1,200 annually for basic coverage like a Business Owner’s Policy, which usually includes liability and property protection. Costs are often higher for restaurant business insurance due to food safety risks, customer traffic, and employee exposure. Final pricing depends on operations, staffing, location, and coverage limits.

2. How much is small business insurance?

Small business insurance costs can range from under $50 to over $100 per month, depending on what you do and how your business operates, including home-based business insurance needs. Low-risk businesses may only need basic general liability, while higher-risk industries pay more.

Bundled options like a Business Owner’s Policy often reduce costs. Your location, revenue, number of employees, and coverage limits all matter, so getting tailored quotes is the best way to know your exact cost.

3. How much is small business insurance per month?

Small business insurance costs vary by policy type, risk level, and business profile, which is why business insurance costs can differ significantly month to month. Most small businesses pay $40 to $300+ per month per policy. A Business Owner’s Policy (BOP) is commonly used to combine essential coverage at a lower overall cost.

Average monthly costs (US):

- General Liability: $40–$85

- Professional Liability (E&O): $42–$117

- Business Owner’s Policy (BOP): $57–$141

- Workers’ Compensation: $45–$125 per employee

- Commercial Auto: $135–$188

Cost drivers: industry risk, location, payroll, coverage limits, and claims history.

4. How much does business insurance cost per month?

Business insurance costs typically range from $40 to $200+ per month per policy, depending on coverage structure and operational risk. Many businesses use a Business Owner’s Policy (BOP) to combine general liability and property coverage at a lower blended cost.

Average monthly costs (US):

- General Liability: $40–$88

- Professional Liability (E&O): $42–$117

- Business Owner’s Policy (BOP): $57–$141

- Workers’ Compensation: $45–$111 per employee

- Commercial Auto: $135–$188

- Cyber Liability: $92–$145

Primary cost factors: industry risk, location, payroll, claims history, coverage limits, and deductibles.

5. How much is business insurance per month for an LLC?

Business insurance for an LLC typically ranges from $25 to $75 per month for basic coverage, with bundled options costing $50 to $100+ monthly. Costs scale with risk and coverage scope.

Typical monthly costs:

- General Liability: $25–$50

- Professional Liability (E&O): $25–$60+

- Business Owner’s Policy (BOP): $50–$100+

- Workers’ Compensation: $45+ (varies by payroll)

Key cost drivers: industry risk, revenue, employee count, location, coverage limits, and policy bundling.

6. How much is liability insurance for a business?

Business liability insurance commonly costs $40–$70 per month (about $500–$800 per year) for general liability, though some low-risk businesses may see rates as low as $19 per month. Costs are often higher for pet business insurance due to animal-related injury and property damage risks. Pricing depends on industry risk, location, revenue, services offered, claims history, and coverage limits.

7. How much is liability insurance for a small business?

General liability insurance typically costs $40–$100 per month, with many businesses paying around $42 monthly (about $500 annually) for standard coverage. Policies with common limits like $1M per occurrence / $2M aggregate often fall near $60–$70 per month.

Cost drivers include:

- Industry risk and services offered

- Business location and foot traffic

- Revenue, employees, and space size

- Coverage limits and claims history

Exact pricing requires a business-specific quote.

8. How much is business liability insurance for an LLC?

Business liability insurance for an LLC usually costs $500–$1,000 per year for basic general liability. More complete coverage, such as a Business Owner’s Policy (BOP), often ranges from $1,200–$1,700 annually. Costs increase with higher-risk industries, more revenue, employees, or higher coverage limits. Service-based LLCs may also need professional liability, which adds additional cost. Exact pricing depends on your specific business profile.

9. How much is insurance for a lawn care business?

Lawn care insurance typically costs $40–$100 per month for general liability, with basic mowing services often on the lower end. Higher-risk work, such as tree trimming or pesticide application, can push costs to $100–$200+ monthly. Workers’ compensation and commercial auto insurance add separate expenses. Pricing depends on services offered, number of employees, equipment used, location, and claims history.

10. How much is insurance for a cleaning business?

Cleaning business insurance usually costs $40–$150+ per month, depending on coverage and risk. Many small cleaning businesses stay under $100 monthly for basic protection.

Typical monthly costs:

- General Liability: $40–$50

- Business Owner’s Policy (BOP): ~$130

- Workers’ Compensation: $90–$130+

- Commercial Auto: $170+

- Cyber Liability: $8–$10

Pricing depends on location, services offered, revenue, employees, and coverage limits.

11. What is business liability insurance?

Business liability insurance protects a company when it is legally responsible for third-party harm. It helps cover:

- Bodily injury to customers or visitors

- Damage to someone else’s property

- Legal defense costs, settlements, and judgments

- Certain personal or advertising injury claims

Common types include general liability, professional liability (E&O), and product liability. It helps protect business assets and is often required by clients or landlords.

12. What is business owners insurance?

Business owners insurance, commonly called a Business Owner’s Policy (BOP), bundles core coverage into one policy. It typically includes general liability, commercial property, and business interruption insurance. A BOP protects against risks like customer injuries, property damage, theft, and lost income from temporary closures. Businesses choose a BOP because it simplifies coverage and usually costs less than buying each policy separately.

13. What is business income insurance?

Business income insurance, also called business interruption insurance, replaces lost income and helps cover ongoing expenses when a covered event forces your business to pause operations.

It typically covers:

- Lost profits you would have earned

- Fixed expenses like rent, payroll, taxes, and utilities

- Temporary relocation costs

It usually applies after physical damage from events like fire or vandalism and is often included in a Business Owner’s Policy (BOP) or added to property insurance.

14. What does business insurance cover?

Business insurance covers financial losses from common operational risks, depending on the policies you carry. Coverage may include:

- General liability: customer injuries, property damage, legal defense

- Property insurance and business personal property insurance: damage to buildings, equipment, and inventory

- Professional liability: errors or negligence in services

- Workers’ compensation: employee injuries

- Business interruption: lost income after covered damage

- Cyber, auto, EPLI, business travel insurance: data breaches, business vehicles, employee claims

Coverage should match your industry, size, and risk exposure.

15. Does business insurance cover theft?

Yes, business insurance can cover theft, but coverage depends on the policy and the type, including risks common to online retail business insurance, such as stolen inventory, warehouse break-ins, or shipping-related losses.

- Commercial property insurance or a BOP often covers burglary or robbery involving forced entry.

- Employee theft or fraud usually requires commercial crime insurance.

- Cash, high-value items, or cyber theft often need separate endorsements or policies.

Always review policy details, as exclusions and limits vary by insurer and coverage type.

16. Does business insurance cover lawsuits?

Yes, business insurance can cover lawsuits, but coverage depends on the policy and the type of claim, including exposures common in food business insurance, such as customer injuries, food-related illness claims, or property damage.

Common policies that cover lawsuits:

- General Liability: Customer injuries, property damage, personal or advertising injury

- Professional Liability (E&O): Mistakes, negligence, or service-related losses

- EPLI: Employee claims like discrimination or wrongful termination

- Product Liability: Harm caused by products

- Cyber Liability: Data breaches and cyber-related legal claims

Usually not covered: intentional acts, criminal behavior, contract-only disputes, or vehicle-related claims without separate coverage.

17. What is business interruption insurance?

Business interruption insurance, also called business income insurance, helps replace lost income and pay ongoing expenses when your business must temporarily close due to a covered event like fire or storm damage.

It typically covers:

- Lost profits you would have earned

- Ongoing expenses such as rent, payroll, and taxes

- Extra costs to reopen faster, like temporary locations

It only applies when tied to a covered property loss and is usually included in a Business Owner’s Policy (BOP) or added to property insurance.

18. What does business interruption insurance cover?

Business interruption insurance covers lost income and ongoing expenses when a covered event forces your business to temporarily close or relocate.

Typically covered:

- Lost income and profits

- Ongoing expenses (rent, payroll, loans, utilities, taxes)

- Extra expenses, such as temporary locations or expedited operations

- Advertising to notify customers

- Contingent losses from disrupted suppliers (if included)

Key limits:

- Triggered only by covered property damage

- Usually excludes pandemics, cyber events, and uncovered perils

- Often added to a Commercial Property policy or BOP

19. Is business insurance necessary?

Yes, business insurance is considered essential for managing financial risk, including retail business insurance, where customer foot traffic, inventory, and leased spaces increase exposure. Some coverage is legally required, while other types are contractually or practically necessary.

Common requirements:

- Workers’ compensation: required in most states if you have employees

- Commercial auto: required for business-owned vehicles

- Contracts/leases: clients or landlords often require liability coverage

Beyond compliance, insurance helps absorb costs from lawsuits, property damage, interruptions, or cyber incidents, reducing the risk of severe financial disruption.

20. When do I need business insurance?

You need business insurance as soon as you start operating, especially once real risk is present, including scenarios that require construction business insurance due to jobsite hazards and regulatory exposure.

Common triggers:

- Hiring employees: workers’ compensation is often legally required

- Leasing or owning space: liability and property coverage are usually needed

- Working with clients or the public: protects against injury or property damage claims

- Providing professional services: errors and omissions coverage applies

- Using vehicles or handling data: commercial auto or cyber insurance may be necessary

If your business could face lawsuits, losses, or interruptions, insurance should be in place early.

21. Do I need general liability insurance for my business?

General liability insurance is usually not legally required, but it is essential for most businesses, including business insurance for consultants who meet clients, work onsite, or interact with third parties. It covers lawsuits, medical costs, and property damage claims, such as accidental damage at a client’s location.

Many clients and partners require proof of coverage before contracts begin, making it a common baseline requirement.

22. Do I need business insurance if I have an LLC?

Yes. An LLC protects your personal assets, not your business’s money, property, or operations. Lawsuits, accidents, data breaches, or employee injuries can still drain the company itself. Business insurance covers those financial losses.

Common needs include general liability, professional liability, workers’ compensation, and property or cyber coverage. Insurance is also often required by law or client contracts, even when operating as an LLC.

23. Can you get business insurance without a business license?

Yes, in some cases, you can get business insurance without a license, especially for general liability if you’re a sole proprietor or LLC with low-risk activities. Insurers often focus on what you do, not your licensing status.

However, many policies, like workers’ compensation, commercial property, or regulated trades, require proof of a valid license. Getting licensed first usually expands coverage options and avoids issues later.

24. Is business insurance tax deductible?

Yes, most business insurance premiums are tax-deductible as ordinary and necessary business expenses, including coverage commonly purchased under self-employed business insurance arrangements.

Common deductible policies include:

- General liability and professional liability (E&O)

- Commercial property and business interruption

- Workers’ compensation and commercial auto

- Cyber liability

- Employee health insurance premiums

Usually not deductible: Life insurance where the business is the beneficiary, disability insurance, and personal insurance. Deductions are claimed based on your business structure, so tax guidance is recommended.

25. Can you deduct life insurance premiums as a business expense?

Generally, no. Business life insurance premiums are not tax deductible if the business is the direct or indirect beneficiary of the policy. This commonly applies to key person insurance or policies used to fund buy-sell agreements.

Premiums may only be deductible in limited situations where the business is not the beneficiary and the coverage is treated as employee compensation, subject to strict IRS rules.

26. How to get liability insurance for a business?

Getting liability insurance is a straightforward process:

- Assess your risks: customer visits, services offered, products sold, and employees

- Choose coverage types and limits: general liability, professional liability, product liability

- Prepare details: revenue, location, operations, employees, claims history

- Compare business insurance quotes from brokers, insurers, or online tools

- Purchase the policy: review exclusions and obtain a certificate of insurance

Review coverage regularly as your business changes.

27. How much does property insurance cost for a small business?

Commercial property insurance for a small business typically costs $60–$70 per month (about $720–$840 per year), though prices can range from $25 to $250 monthly. Costs depend on the replacement value of your building and assets, business location, industry risk, building age, safety features, occupancy, and claims history. Businesses in high-risk areas or with valuable equipment usually pay more.

Related Reads

Auto Insurance FAQ: Your Complete Guide to Coverage, Claims & Costs

Travel Insurance FAQ: What Coverage Do You Really Need Before Your Trip?