Most business loans don’t get serious attention until cash flow tightens, an expansion window opens, or a lender asks for more documentation than expected. A small detail, like DSCR assumptions, collateral coverage, or how proceeds are categorized, can change pricing, approval odds, and even what product you qualify for.

A business loan isn’t a single product; it’s a structure made up of terms, guarantees, security, covenants, and underwriting standards that vary across banks, SBA lenders, and online providers.

Whether you’re planning financing, comparing offers, or tightening an application package, here’s a clear breakdown of the key business loan questions, answered directly.

(This article provides general information, not legal, tax, or financial advice. Loan programs and eligibility rules can change, so confirm details with your lender and a qualified professional.)

Summary

- Show a clear purpose and strong paperwork: Lenders want a specific use of funds, complete documentation, and a well-organized application.

- Prove you can repay: Solid cash flow and a strong repayment track record drive approval, while credit history, time in business, and guarantees affect terms.

- Choose the right loan type and understand trade-offs: Options include bank and SBA loans, online loans, and asset-based financing; speed, cost, collateral, and down payment requirements vary.

1. How to get a business loan?

This is the big-picture roadmap from choosing a loan to getting funded:

- Pick the right loan type for your goal: working capital, equipment, inventory, or expansion financing. All fit different products.

- Check your eligibility and prepare the basics: credit, revenue, time in business, and a simple plan for repayment.

- Apply, then compare offers before signing: evaluate APR, fees, term length, and payment schedule.

2. How to secure a business loan?

This focuses on what increases approval odds and improves loan terms:

- Strengthen your financial profile: improve credit, clean up financial statements, and reduce major red flags.

- Prove repayment ability clearly: show consistent cash flow and a realistic payment plan based on actual numbers.

- Reduce lender risk: offer a down payment, collateral, or a personal guarantee when needed.

3. How to get a business loan from a bank?

This covers bank-specific expectations and why bank loans work differently:

- Meet stricter requirements: Many banks prefer 2+ years, but some will consider strong applicants with less history.

- Prepare a full documentation package: Tax returns, financial statements, bank statements, and business legal documents.

- Expect a slower but lower-cost process: Underwriting takes longer, but rates may be more competitive than online lenders.

4. How to apply for a business loan?

This is the application checklist and how to avoid delays during review:

- Choose the lender and loan product first: this determines what documents you’ll need and what standards you must meet.

- Submit a complete, consistent application: match figures across tax returns, financials, and bank statements.

- Respond fast and verify details: follow up quickly, then review the final offer terms before accepting.

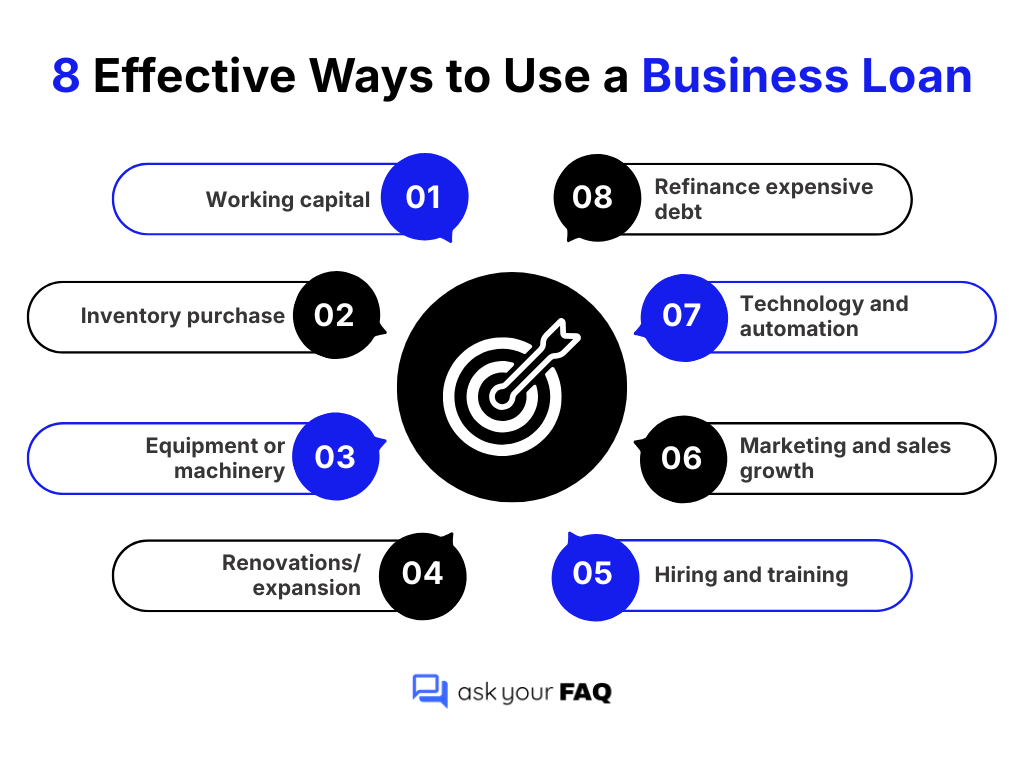

Once you’re ready to apply, use this infographic for ideas on common, lender-friendly ways to use a business loan.

5. Is it difficult or hard to get a business loan?

It can be difficult to get a business loan, depending on your credit profile, cash flow, and time in business. Traditional banks have stricter standards and typically favor established businesses with strong financial records.

Businesses that do not meet bank requirements may still qualify through SBA programs or alternative lenders, though these options often involve higher costs or shorter repayment terms.

6. How to get a startup business loan?

Create a clear business plan and repayment plan,

→ Improve personal credit and prepare 3-year projections

→ Gather documents (tax returns, bank statements, licenses)

→ Decide if you can offer collateral

→ Compare lenders (banks/credit unions, online lenders, SBA partners)

→ Use SBA Lender Match to find SBA options, including microloans for startups (SBA eligibility and terms vary by lender and program; confirm current requirements before applying.)

→ Apply and respond quickly to follow-up questions

→ If you’re new, start small and build business credit.

7. How to get a startup business loan with no money?

This is how to find funding alternatives and improve your chances of approval.

- Explore alternative funding options first: consider SBA microloans, nonprofit microloans, business credit cards, crowdfunding, angel investors, equipment financing, or personal loans. Also, look at community banks, local programs, and grants where available.

- Improve approval odds and build credibility: create a detailed business plan with realistic projections, use collateral (like equipment) if possible, consider a co-signer and expect a personal guarantee, improve personal credit, and start small by building business credit through on-time payments.

8. How to get a startup business loan with bad credit?

This focuses on financing when you have limited business history, and lenders can’t rely on long revenue records.

- Target startup-friendly options: SBA Microloans, CDFIs, nonprofit microloans, equipment financing, and select online lenders that review deposits or contracts.

- Strengthen what lenders can verify: a clear plan, realistic projections, proof of demand (orders/contracts), and documentation that supports your assumptions.

- Reduce lender risk: bring a co-signer, offer collateral when possible, and start with a smaller loan to build repayment history.

9. How to get a business loan with bad credit?

This is for an operating business with revenue, where cash flow and bank deposits can outweigh credit score.

- Use cash-flow-based lenders: online lenders, CDFIs, invoice financing, equipment financing, or revenue-based products when needed.

- Show strong repayment capacity: steady deposits, clean financials, and separation of business and personal finances.

- Borrow smart: use collateral or a co-signer if possible, start smaller to build history, and compare APR, fees, and payment schedules while avoiding unclear terms.

10. Can I get a business loan with a 500 credit score?

Yes, it’s possible to get a business loan with a 500 credit score, but options are limited and typically expensive. Lenders that approve at this level usually rely more on cash flow or collateral than credit scores.

Expect higher interest rates, shorter terms, and stricter repayment structures compared to bank or SBA loans.

11. What is the easiest business loan to get?

The easiest business loan to get is usually an online lender line of credit or short-term working capital loan.

Online lenders often approve faster than banks. Common “easier” options include lines of credit, working capital loans, equipment financing, and sales-based funding. SBA microloans may also be easier for smaller amounts.

The trade-off is cost; easier approval often comes with higher APR or fees, so compare total repayment before signing.

12. Can you get a business loan with no credit?

Yes, you can get a business loan with no credit, but options are usually limited and can cost more. Good starting points include microloans (CDFIs or SBA microloans), invoice factoring (based on your customers), equipment financing, or crowdfunding/P2P lending.

If you process card sales, sales-based funding may be available, but it’s often expensive. Lenders will focus on cash flow, collateral, and your business plan. Avoid “guaranteed approval” offers and compare total fees.

13. How to qualify for a business loan?

Good personal and business credit (often ~680+),

→ Steady revenue and cash flow

→ Enough time in business (commonly 2+ years, though some startups qualify)

→ Solid financial records and tax returns

→ A clear plan for how you’ll use the funds

→ Acceptable DSCR (cash flow to cover payments)

→ Collateral may be required for some loans

→ Many lenders also require a personal guarantee.

14. How much collateral is needed for a business loan?

Most lenders want enough collateral to cover the loan if you default, but they usually lend only a portion of an asset’s value.

- If you have strong credit + strong cash flow, you may need less collateral or qualify with a personal guarantee only.

- If you have weaker credit or a larger loan, expect more collateral coverage or multiple assets.

Rule of thumb: the riskier your profile, the more collateral (or stronger assets) you’ll need.

15. How much deposit for a business loan?

Deposits (equity injections) depend on loan type and risk, but typical ranges are:

- 10%–15% for many standard loans from banks and alternative lenders, including many SBA loans (varies by credit, finances, use of funds, collateral, and time in business).

- Up to ~35% for some commercial real estate loans, where the property usually serves as collateral.

- Around 5% or sometimes waived (rare): more likely when you have a strong existing lender relationship and substantial cash flow, often with shorter repayment terms.

(Deposit requirements vary widely by lender, loan program, and deal structure; verify current requirements with your lender.)

16. What is a business term loan?

A term loan is the “classic” loan: one lump sum, fixed repayment schedule, fixed end date.

Choose a term loan when you want predictable payments, and you’re funding something with a clear payoff timeline (growth, equipment, expansion, refinance).

17. What is a secured business loan?

A secured loan is backed by collateral (equipment, property, inventory, receivables).

Pick secured when you want better rates or a larger loan, or when your credit profile needs support. The trade-off is that the lender can seize the pledged asset if you don’t repay.

18. What is an unsecured business loan?

An unsecured loan is not backed by collateral; approval leans on cash flow, credit, and business history.

Pick unsecured when you need speed or don’t have assets to pledge, but expect higher cost and/or shorter terms. Many still require a personal guarantee.

19. How does a business loan work?

Apply and share your use of funds plus key financial documents,

→ Lender underwrites credit, revenue, time in business, and risk

→ If approved, you get terms (rate, fees, repayment schedule)

→ Funds are released (lump sum or line of credit)

→ Repay on schedule

→ Collateral or a personal guarantee may be required.

20. How does business loan repayment work?

Receive funds,

→ First payment is due on the lender’s schedule (often within 30 days)

→ Make scheduled payments that cover principal and interest

→ Payment frequency may be monthly, weekly, or daily, depending on the product

→ Fixed-rate stays the same, variable-rate can change

→ Longer terms lower payments but raise total cost

→ Missed payments can lead to late fees, credit damage, default, and collateral loss on secured loans.

21. Does a business loan affect personal credit?

Yes, it can. Most likely, when you sign a personal guarantee, operate as a sole prop/partnership, or use a lender that reports to personal bureaus.

→ Applying may trigger a hard inquiry

→ Missed payments, defaults, or high balances can lower your score

→ Reduce impact by separating business finances, building business credit, and confirming reporting policies before signing.

22. How long does it take to get a business loan?

Funding speed depends on the lender and loan type.

→ Online lenders can fund in 24–48 hours for short-term loans, lines of credit, or merchant cash advances (usually higher cost)

→ Banks often take about 1–3 weeks, sometimes longer, because underwriting is stricter

→ SBA loans typically take 30–90 days due to paperwork and approvals

→ Faster funding usually means higher rates, while slower options often offer better terms.

23. Is it hard to get a business loan with an LLC?

Getting a business loan with an LLC isn’t automatically difficult,

→ Lenders still evaluate credit, revenue, cash flow, and time in business

→ Established LLCs with 1–2+ years of financials and strong personal/business credit usually qualify more easily, especially with banks

→ Newer LLCs may need online lenders or SBA options and may face higher rates

→ Many lenders still require a personal guarantee, especially for smaller or newer businesses.

24. How to get a business loan for a restaurant?

Show restaurant-specific revenue proof (bank deposits, POS sales, financials),

→ explain exactly how funds will increase revenue

→ match the loan to the need (renovations, equipment, inventory/working capital)

→ compare restaurant-friendly lenders (banks, SBA, online)

→ apply and respond to underwriting

→ expect a personal guarantee and sometimes collateral, especially for newer restaurants.

25. How to get a loan to buy a business?

Choose a financially healthy business and review its records,

→ build an acquisition plan showing how you’ll operate and grow it

→ prepare buyer documents (credit, financials, personal financial info)

→ choose the right financing route (often SBA 7(a), bank loan, seller financing, or online)

→ apply and clear underwriting

→ finalize terms before closing, including down payment and personal guarantee.

26. How hard is it to get a loan to buy a business?

Getting a loan to buy a business can be challenging but very achievable, especially if the business has strong, verifiable cash flow. Lenders look at your personal credit, relevant management experience, the business’s financial health, and your down payment (often 10–30%; SBA deals may be closer to 10–15%).

Banks usually have stricter standards, SBA loans offer better terms, but more paperwork, and online or seller financing can be more flexible but costlier.

27. Can you use a business loan to buy a house?

Business loans generally can’t be used to buy a personal home. Most lenders require business funds to be used for business purposes. However, loans like SBA 7(a) or 504 can be used to buy owner-occupied commercial real estate (usually, the business must occupy at least 51%). If you want a house for personal use, a traditional mortgage is usually simpler and cheaper.

(Program rules and occupancy thresholds can change and may vary by lender; confirm current SBA and lender requirements before applying.)

28. How to get a business vehicle loan?

Choose the vehicle type and set a budget (insurance + maintenance),

→ Check personal and business credit

→ Gather documents (registration, EIN, tax returns, bank statements, vehicle VIN/price, insurance)

→ Compare lenders (banks, credit unions, online lenders, dealerships, SBA options)

→ Apply with the best-fit lender

→ Review APR, fees, and term (often 12–72 months)

→ Sign, fund, and register the vehicle in the business name.

29. How to get a large business loan?

Define amount + purpose,

→ Show strong credit and steady cash flow

→ Gather core docs (tax returns, financials, bank statements)

→ Add collateral if needed

→ Compare lenders (bank, SBA, online)

→ Apply and respond fast

→ Review APR, fees, and terms before signing.

30. Can you get a business loan without collateral?

Yes, you can get a business loan without collateral through unsecured options like term loans, lines of credit, business credit cards, revenue-based financing, or merchant cash advances. Some SBA 7(a) loans under $50k may not require collateral, but lenders still review credit, revenue, and time in business. Many lenders require a personal guarantee. Unsecured loans usually cost more than secured loans.

31. How to get an unsecured business loan?

This is a step-by-step checklist for getting an unsecured business loan.

- Strengthen personal and business credit (often 680+ helps)

- Show steady revenue and cash flow (many lenders prefer 1–2+ years in business)

- Prepare key documents (tax returns, bank statements, P&L, EIN, ID)

- Compare lenders (banks/credit unions for better rates, online lenders for faster funding)

- Apply with the best-fit lender

- Review the offer before signing (APR, fees, repayment terms, and whether a personal guarantee is required)

32. Are business loan payments tax deductible?

Business loan principal payments aren’t tax-deductible because you’re just paying back borrowed money. The interest portion is usually deductible if the loan funds were used for legitimate business expenses and you’re legally responsible for the debt.

Keep clear records showing how funds were used and how much interest you paid. If the loan was used partly for personal spending, only the business-use portion may qualify.

(This is general tax information, not tax advice. Deductibility depends on your situation; confirm with a qualified tax professional.)

33. Can you refinance a business loan?

Yes, you can refinance a business loan by replacing your current loan with a new one, often to lower your interest rate, reduce monthly payments, extend the term, switch from variable to fixed rates, or consolidate multiple debts.

To refinance, review your current payoff amount and any prepayment penalties, compare offers from multiple lenders, and apply with updated financials. Always weigh the new fees and total cost against the savings.

(Refinancing terms, fees, and eligibility vary by lender and loan type; review your current loan agreement and new offer terms carefully.)

34. How to raise money for a business without a loan?

This covers ways to fund a business without taking on a traditional loan.

- Bootstrap: personal savings, reinvest profits, or sell assets.

- Raise equity: angel investors or venture capital for ownership.

- Use customer funding: crowdfunding or pre-sales.

- Get non-repayable money: grants or pitch competitions.

- Tap business support: partnerships, incubators, or accelerators.

These options trade ownership, control, or future revenue instead of debt.

35. Can I use my EIN to get a loan?

Yes, you can use your EIN (Employer Identification Number) to get a business loan, as it’s your business’s unique ID, but lenders usually need more than just the EIN; they look for a solid business credit profile, revenue, assets, and cash flow to assess risk, especially for newer businesses where personal credit might also be checked, though some alternative lenders focus purely on business metrics.

(Qualification and credit checks vary by lender; confirm whether personal credit will be reviewed and whether the lender reports to business or personal bureaus.)

36. Can I buy a car under my LLC name?

Yes, an LLC can own a vehicle, but the vehicle must be titled and registered under the business entity rather than an individual’s name. This setup legally makes the vehicle a business asset, which can provide liability protection, financial advantages, and potential tax deductions.

(Registration rules and tax treatment vary by state and how the vehicle is used; confirm with your DMV and a tax professional.)

37. How much can a new LLC get a loan for?

A new LLC can get approved for credit, but limits can range from a few thousand dollars to $100,000+ based on the owner’s personal credit, business revenue, time in business, and the lender.

Banks typically require more operating history, while online and cash-flow-focused lenders may approve earlier. Most new LLCs start with smaller limits and often need a personal guarantee until business credit is established.

38. Is the interest rate the most important factor to consider?

Not always. The most important factor is the total cost and affordability of repayment. A low rate can still be expensive if fees are high or the term is short. Compare APR, fees, payment frequency, total repayment, prepayment penalties, and whether payments fit your cash flow.

Related Reads

Car Loans FAQ: How to Apply, Manage, Refinance & Pay Off Smartly