Homeowners today hold record levels of equity, and many don’t realize how much financial flexibility it can create. The challenge isn’t the loan itself; it’s sorting through scattered explanations, slow lender replies, and information that feels incomplete. That confusion can make a great opportunity seem out of reach.

The good news is that the process becomes far easier once the essentials are explained in plain language. This blog gives you clear, direct answers to the questions most borrowers ask, so you can tap into your home’s value confidently and choose the option that fits your goals.

How does a home equity loan work?

A home equity loan gives you a lump sum based on the equity you’ve built in your home. It operates as a separate, fixed-rate mortgage with set monthly payments. Your home secures the loan, and you repay the balance over a defined term.

Can you get a home equity loan on a mobile home?

You can get one, but the home usually needs to be classified as real property. That means it must be permanently attached to land you own, meet HUD foundation standards, and carry proper titling. Mobile homes on leased lots rarely qualify.

Can I get a home equity loan while in Chapter 13 bankruptcy?

It’s possible, but requires:

- Court approval

- Trustee approval

- Lender verification that payments are current

Approval is far more restrictive than standard lending.

What disqualifies you from getting a home equity loan?

Lenders look at your overall risk profile. Common red flags include:

- Low credit score

- Insufficient equity

- High debt-to-income ratio

- Unstable income history

- Recent late mortgage payments

- Property with structural or title issues

What credit score is needed for a home equity loan?

Lenders usually want to see a credit score of 620 or higher for basic approval. The best rates and largest loan amounts typically go to borrowers in the 700–740+ range, where risk is lower, and underwriting is more flexible.

Can you get a home equity loan with bad credit?

Yes. Approval is possible, but the requirements are stricter.

What “bad credit” usually means:

- Credit scores below the mid-600s (roughly under 640–660)

What lenders expect:

- Strong home equity

- Higher interest rates

- Stricter debt-to-income limits

- Some lenders offer subprime home-equity options

Bad credit doesn’t block approval, but it narrows lender choices and increases cost.

What are the requirements for a home equity loan?

Typical requirements:

- Sufficient home equity (15–20% minimum)

- Stable income

- Acceptable credit score

- Verifiable property value

- Manageable debt-to-income ratio

Is it easy to get a home equity loan?

The process is usually straightforward if you have enough equity, good credit, and a steady income. It becomes more challenging when debt levels are high, credit scores are weaker, or your financial documents don’t show consistent repayment ability.

Is a home equity loan a mortgage?

A home equity loan is classified as a mortgage because it’s secured by your property and recorded as a lien. It operates independently from your first mortgage, with its own rate, repayment schedule, and balance tied directly to your available equity.

Is a home equity loan a second mortgage?

A home equity loan typically functions as a second mortgage since it adds another lien behind your primary mortgage. It carries its own rate, term, and payment schedule, and it’s backed by the equity you’ve built in the property.

Is an appraisal required for a home equity loan?

Lenders usually need a current property valuation to confirm available equity.

Common valuation methods:

- Full interior appraisal

- Automated valuation models (AVMs)

- Exterior-only reviews for lower-risk files

Cost detail:

- The appraisal fee is typically included in the closing costs.

This step helps the lender verify loan-to-value limits before approving the loan.

What do appraisers look at for a home equity loan?

Appraisers assess the property’s value to confirm available equity. Key factors include:

- Square footage and layout

- Structural condition

- Comparable sales

- Lot characteristics

- Improvements and upgrades

- Local market trends affecting property values

Can you get a home equity loan without an appraisal?

Some lenders allow it when the risk is low, using automated valuation models or drive-by assessments instead. Still, many loan programs rely on a full appraisal to confirm the home’s value and determine how much equity is actually available.

What do you need for a home equity loan?

Common documentation:

- Income verification

- Credit check

- Mortgage statements

- Homeowner’s insurance

- Property valuation

What are home equity loan rates?

Home equity loan rates are fixed for the entire term, though the exact rate varies by lender and borrower profile.

Key factors that influence the rate:

- Credit score

- Available equity and loan-to-value ratio

- Loan amount and term

- Current mortgage-market conditions

- Overall borrower risk

What is the interest rate on a home equity loan?

Rates usually fall between first-mortgage rates and unsecured loan rates. Lenders price home-equity products based on risk, credit strength, and broader market trends.

What is the average home equity loan rate?

Average rates tend to follow broader mortgage trends and typically sit slightly above standard 30-year fixed mortgage rates. The actual average varies based on borrower credit, available equity, loan term, and the pricing models individual lenders use at the time.

How much of a home equity loan can I get?

Your approval amount depends on:

- Home value

- Equity amount

- Income

- Credit

- Debt obligations

How fast can you get a home equity loan?

Funding can happen in 7–14 days when the lender relies on automated valuations and streamlined underwriting. If a full appraisal or more detailed review is required, the timeline usually shifts to 14–30 days, based on how quickly documents and property reports are completed.

How long does it take to get a home equity loan?

The full process typically takes 14–30 days, depending on how quickly the appraisal, verification, and underwriting steps are completed. Automated valuations can shorten the timeline, while full interior appraisals or slower document turnaround usually lead to a longer process.

How long does a home equity loan take to close?

Closing usually takes 14–45 days, depending on how quickly the appraisal, title work, and income documents are completed. Automated or exterior appraisals can speed things up, while full interior inspections or complex financial reviews often add extra time.

What can you use a home equity loan for?

Common uses include:

- Home improvements

- Debt consolidation

- Education costs

- Major purchases

- Investment capital

What is a home equity loan used for?

People use home equity loan funds for many larger expenses, including home renovations, debt consolidation, education costs, medical bills, major purchases, or real estate investments. Because the loan has fixed terms, it works well for planned projects that benefit from predictable monthly payments.

Can I use a home equity loan to buy another house?

You can use a home equity loan to help purchase another property. Many buyers put the funds toward a down payment, an investment purchase, or a second home because the loan offers fixed terms without changing their existing mortgage.

How does a home equity loan work for home improvements?

For renovation projects, a home equity loan gives you a single lump sum to use however the project required. The rate and monthly payment stay fixed, which makes budgeting easier, and the funds can cover structural work, system upgrades, or major home updates.

How do you pay back a home equity loan?

Repayment happens through fixed monthly installments that cover both principal and interest. The payment amount stays the same for the entire term, and because the loan is secured by your home, keeping payments on time is essential to protect your equity.

Can you pay off a home equity loan early?

You can usually pay off a home equity loan ahead of schedule, and most lenders don’t charge a penalty for doing it. Paying early can cut interest costs, but it’s still smart to check your loan terms so you know exactly how your lender handles extra payments.

How can you pay off a home equity loan faster?

Options include:

- Making extra principal payments

- Refinancing to a shorter term

- Applying windfalls or bonuses directly to principal

Can you refinance a home equity loan?

A home equity loan can be refinanced in several ways. You can replace it with a new home equity loan, roll it into a new first mortgage, or switch to a HELOC for more flexibility. The best option depends on rates, equity, and long-term plans.

Can you refinance a home equity loan into a mortgage?

You can combine a home equity loan and your existing mortgage into one new first mortgage. This is common when rates drop or when borrowers want a single payment. The new loan pays off both balances and replaces the previous liens.

Can you get a home equity loan without refinancing?

You can. A home equity loan doesn’t replace your current mortgage; it simply adds a separate loan secured by your home’s equity. This lets you borrow without changing your existing mortgage rate, term, or lender.

Does a home equity loan affect your credit?

Yes. It appears as a new credit account and influences:

- Credit utilization (secured)

- Payment history

- Length of credit mix

Does a home equity loan affect your mortgage?

A home equity loan doesn’t change the terms of your existing mortgage. It’s added as a separate lien on the property, so your original loan keeps its rate and payment schedule. The only connection is that both loans share the same collateral, your home.

Is a home equity loan interest tax deductible?

Interest may be deductible, but only when the loan is used for qualified home improvements that add value or extend the life of the property. Using the funds for personal expenses, debt payoff, or non-home purposes doesn’t meet IRS deduction rules.

What happens if you default on a home equity loan?

Defaulting on a home equity loan is serious because the loan is secured by your property. Missed payments can trigger late fees, credit damage, and eventually foreclosure, since the lender has the right to recover the debt through the home’s equity.

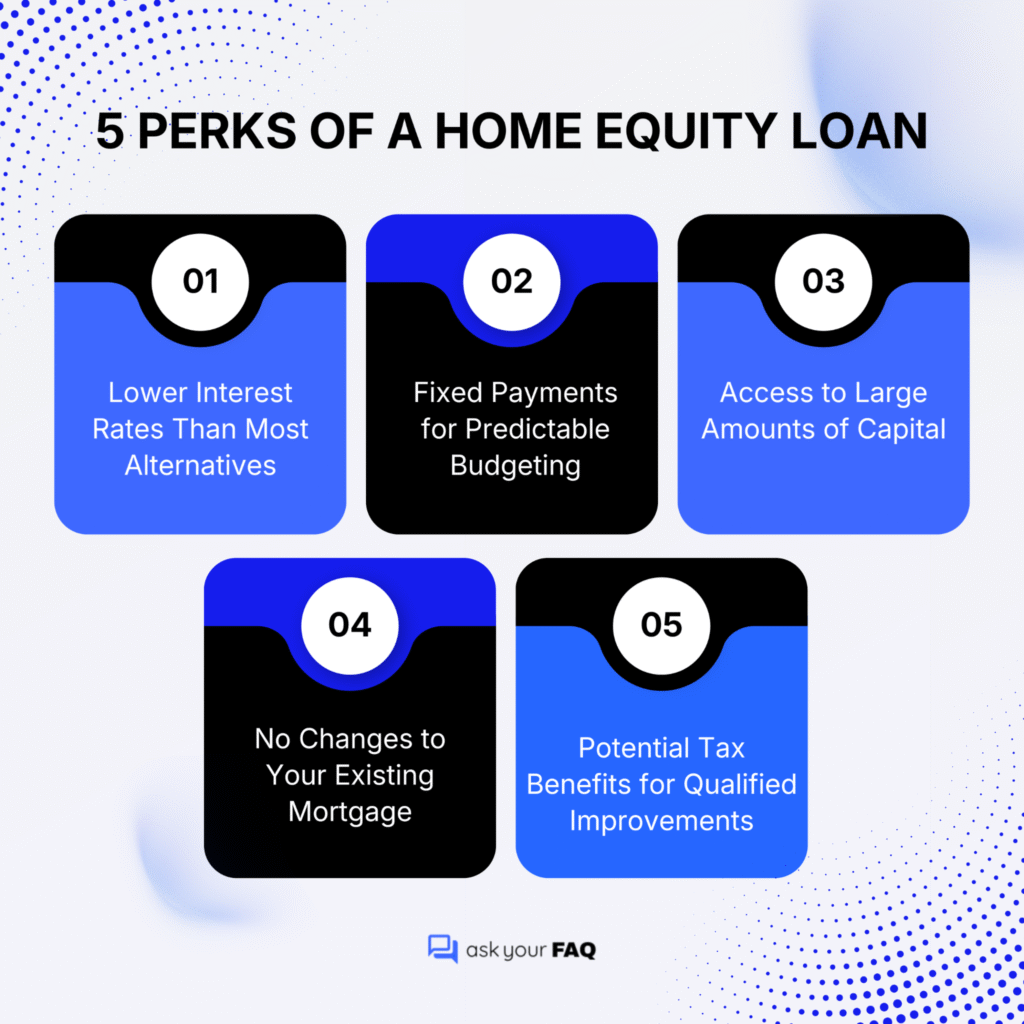

Is a home equity loan a good idea?

A home equity loan can be a solid option when you want predictable payments and long-term financing for major expenses. It often offers lower rates than unsecured borrowing, but it also puts your home at risk, so it works best for planned, manageable costs.

Is a home equity loan a good idea to pay off debt?

Using a home equity loan to pay off high-interest debt can work when the new rate is significantly lower, and you’re committed to avoiding new balances. It converts revolving debt into a fixed payment, but it also puts your home at risk if repayment becomes difficult.

Should I get a home equity loan?

It suits borrowers who:

- Have a stable income

- Have long-term financial goals

- Want fixed payments and predictable terms

Are there closing costs on a home equity loan?

Most home equity loans include closing costs. You may see fees for the appraisal, title work, recording, and lender processing. These costs are usually lower than a full mortgage refinance, but the exact amount depends on the lender and property location.

How much does a home equity loan cost?

Costs include:

- Interest

- Appraisal fees

- Origination charges

- Recording fees

How do you calculate a home equity loan?

A home equity loan is calculated by looking at the loan amount, interest rate, and repayment term. Lenders use these factors to create a fixed monthly payment through an amortization schedule. Your available equity and credit profile help determine how much you can actually borrow.

How do you calculate a home equity loan payment?

Payments are based on an amortization formula using:

- Principal

- Interest rate

- Loan term

Example

A $40,000 loan at 7% for 10 years produces a monthly payment of about $464 using the amortization formula.

How many years is a home equity loan?

Home equity loan terms typically range from 5 to 30 years, depending on the lender and loan size. Shorter terms offer faster payoff and less interest, while longer terms reduce the monthly payment but increase total interest over the life of the loan.

Which is better: refinance or a home equity loan?

- Choose a refinance if you want a new first-mortgage rate.

- Choose a home equity loan if you want to keep your current mortgage untouched.

Which is better: HELOC or home equity loan?

- HELOC → flexible, revolving credit

- Home Equity Loan → fixed rate, fixed payment

The best option depends on whether you want flexibility or predictability.

Which is better: a home equity loan or a line of credit?

The better choice depends on how you plan to use the money. A home equity loan works well for a single, fixed-cost project, while a line of credit offers flexible access to funds for expenses that shift or unfold over time.

What is a home equity investment loan?

Instead of taking on a traditional loan, you receive a lump sum from an investment company in exchange for a share of your home’s future value. There are no monthly payments, because the investor is compensated when you sell or refinance.

Is a home equity investment loan a good idea?

The appeal depends on your priorities. This option helps if you need cash but don’t want another monthly payment. The trade-off is giving up a portion of your home’s future value, which can be costly if your property appreciates significantly.

When can you get a home equity loan?

You’re eligible once you’ve built enough equity in your home, usually around 15–20%. Lenders also look for stable income, acceptable credit, and a clean title. As long as those factors check out, you can apply at almost any time.

What bank has the best home equity loan?

No single bank consistently offers the best option for every borrower. Rates, fees, and loan limits vary based on your credit, location, and property type. The most reliable approach is to compare several lenders to see who matches your profile and goals.

Putting Your Home’s Equity to Work?

A home equity loan can be a practical way to unlock financial flexibility, but it works best when you understand the rules, requirements, and trade-offs. With the right information, the process becomes far more straightforward and predictable.

Use this FAQ as a reference point as you evaluate your needs, compare lenders, and plan the next steps. Clear information leads to better decisions, and a well-structured approach helps you make the most of the equity you’ve already built.