Ever felt lost trying to file a home insurance claim after unexpected damage? Navigating home insurance claims can be overwhelming, especially when you’re facing property loss or dealing with the responsibilities tied to a home loan.

From figuring out what’s covered to knowing how to file and track a claim, there’s a lot to manage. One small mistake or delay can lead to denied payouts or unexpected out-of-pocket costs. That’s why we created this comprehensive home insurance FAQ to break it all down in plain language.

Whether you’re new to homeownership or trying to understand your current policy better, these answers will help you stay informed, avoid surprises, and handle claims with confidence. Let’s start with the essentials and walk through what your policy protects and what to do when you need to file a claim.

Understanding Home Insurance Basics

Your home is likely one of your biggest investments, and protecting it is crucial. Home insurance offers financial security against damage, loss, or liability, ensuring you’re not left paying out of pocket for unexpected events.

The questions below offer clear, practical answers to help you understand how home insurance works and what to keep in mind when selecting a policy.

Why do you need home insurance?

Home insurance protects your home and personal belongings from unexpected events like fire, theft, or natural disasters. It also provides liability coverage if someone is injured on your property.

Without it, you would have to pay out of pocket for major repairs, replacements, or legal costs. Home insurance gives financial security and peace of mind, especially during emergencies.

Is home insurance required by law?

Home insurance is not required by federal or state law, but if you have a mortgage, your lender will likely require it as part of your loan agreement. Even if it’s not legally mandated, having home insurance is strongly recommended to protect your investment from damage or liability risks.

What’s the difference between homeowners and renters insurance?

| Feature | Homeowners Insurance | Renters Insurance |

| Who Needs It | People who own their home | People who rent their home or apartment |

| What It Covers | Structure of the home + personal belongings + liability | Personal belongings + liability (not the structure) |

| Building Structure Coverage | Yes | No |

| Required by Mortgage/Landlord | Often required by mortgage lenders | Often required by landlords |

| Cost | Generally more expensive | Typically more affordable |

How much home insurance coverage do I need?

The amount of home insurance you need depends on:

- Rebuilding cost of your home (not market value).

- Value of your personal belongings.

- Liability protection in case someone sues you.

- Additional living expenses if you need to live elsewhere temporarily.

A good rule is to insure your home for 100% of the cost to rebuild and keep an updated inventory of your belongings to determine personal property limits.

What types of events are typically covered under home insurance?

Most standard home insurance policies cover the following:

- Fire and smoke damage

- Theft or vandalism

- Storms (wind, hail, lightning)

- Water damage from burst pipes or appliance leaks

- Falling objects (like trees)

- Damage from vehicles or aircraft

- Liability for injuries on your property

- Additional living expenses if your home becomes uninhabitable

Note: Events like floods and earthquakes are usually not included and require separate policies.

Does home insurance cover both the structure and personal belongings?

Yes, standard home insurance policies cover both the structure of your home (like walls, roof, and built-in fixtures) and your personal belongings (such as furniture, clothing, and electronics).

The structure is typically covered under dwelling coverage, while your items fall under personal property coverage. However, coverage limits may apply, and you may need to add extra protection for high-value items like jewelry or collectibles.

How is the value of my home calculated for insurance purposes?

Insurance companies calculate your home’s value based on the reconstruction cost, not its market value. This means they estimate how much it would cost to rebuild your home from the ground up using current labor and material prices.

Key factors include:

- Square footage and layout

- Construction materials and finishes

- Location and local building costs

- Home features (e.g., fireplaces, basements, custom work)

- Age and condition of the home

They may also use tools like property inspections or building cost calculators to arrive at an accurate insured value.

Filing a Home Insurance Claim

When damage or loss happens, knowing how to respond quickly can make a big difference. Filing a home insurance claim the right way helps you recover faster and ensures you receive the coverage you’re entitled to without unnecessary delays.

The questions below walk you through each step so you can handle the process with clarity and confidence.

When should I file a home insurance claim?

You should file a home insurance claim when your property experiences damage, loss, or liability that is covered under your policy, and the repair or replacement costs exceed your deductible.

This includes events like fire, theft, storm damage, or injuries to someone on your property. If the damage is minor and costs less than your deductible, it may not be worth filing.

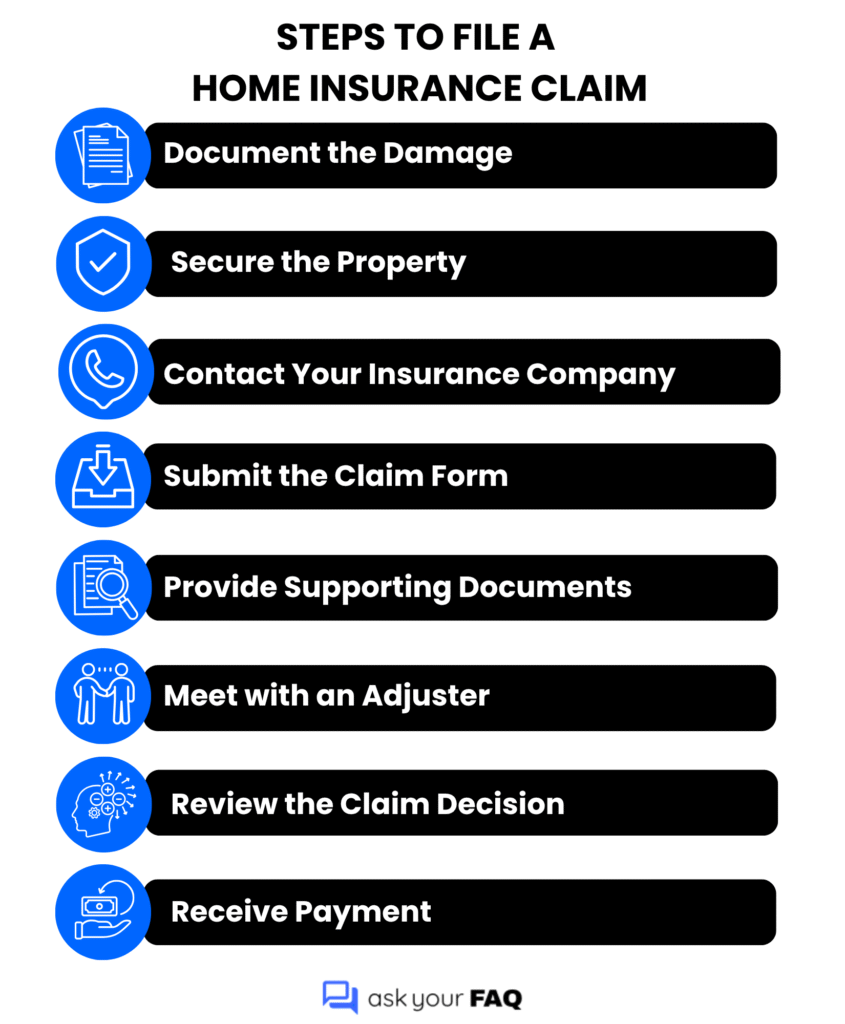

What is the process for filing a home insurance claim?

To file a home insurance claim, follow these steps:

What documents or proof do I need to submit a claim?

When submitting a home insurance claim, you typically need:

- Photos or videos of the damage

- Itemized list of damaged or stolen belongings

- Receipts or proof of ownership (if available)

- Police report number (in cases of theft or vandalism)

- Repair estimates or invoices from licensed professionals

- Completed claim form provided by the insurer

Providing detailed documentation helps speed up the claim process and ensures accuracy.

How long do I have to file a claim after an incident?

Most home insurance policies require you to file a claim within 30 to 60 days of the incident. However, it’s best to report the damage as soon as possible to avoid delays or disputes. Check your policy for the exact filing deadline, as time limits may vary depending on the insurer and the type of loss.

How long does it take to get reimbursed after a claim is approved?

Once your claim is approved, reimbursement usually takes between a few days to a few weeks, depending on the complexity of the claim and your insurer’s process. Minor claims are often paid out faster, while more severe damage may take longer due to inspections, paperwork, or contractor estimates. Direct deposit payments tend to arrive sooner than mailed checks.

Understanding Claims Coverage and Payouts

Not all damages are treated equally, and not every loss leads to a full payout. Understanding what your policy covers, how insurers calculate compensation, and when payouts are approved helps you set the right expectations. In some cases, especially after severe financial hardship or bankruptcy, knowing how and when your insurance will respond becomes even more critical.

The questions below explain how coverage decisions are made and what factors affect your final claim amount.

What is a deductible, and how does it affect my claim?

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. For example, if your deductible is $1,000 and your repair costs are $5,000, the insurer will pay $4,000.

A higher deductible usually means a lower monthly premium, but you’ll pay more upfront in the event of a claim. Choosing the right deductible is important; it directly affects how much you receive and how much you’re responsible for when filing a claim.

How do insurers determine the payout amount?

Insurers calculate your payout based on:

- Type of coverage (replacement cost or actual cash value)

- The deductible amount you’ve chosen

- Extent of damage and documented loss

- Depreciation for older or worn-out items

- Policy limits and exclusions that cap or restrict certain categories

They’ll also factor in any applicable endorsements or optional coverage you added to your policy. A claims adjuster may visit to assess damage before finalizing the payout.

What’s the difference between replacement cost and actual cash value?

| Feature | Replacement Cost | Actual Cash Value |

| Definition | Pays the full cost to replace the item with a new one | Pays the value of the item minus depreciation |

| Payout Amount | Higher | Lower |

| Depreciation Applied? | No | Yes |

| Example | The new TV, worth $800, is fully reimbursed | Same TV reimbursed for $500 after wear and age |

| Premium Cost | Generally higher | Usually lower |

Will my insurance cover temporary housing if my home is unlivable?

Yes, most standard home insurance policies include Additional Living Expenses (ALE) coverage. This pays for temporary housing, meals, and other necessary costs if your home becomes uninhabitable due to a covered event, such as fire or storm damage, while repairs are underway. Keep all receipts, as your insurer may reimburse only reasonable and documented expenses up to the policy limit.

Are personal belongings inside the home covered?

Yes, personal belongings like furniture, electronics, clothing, and appliances are typically covered under your home insurance policy. Coverage applies to loss or damage from covered events such as fire, theft, or vandalism. However, there may be limits on high-value items like jewelry or art unless you purchase extra coverage. It’s a good idea to keep a home inventory with receipts or photos to make the claims process easier.

Common Claim Scenarios

From burst pipes to storm damage, homeowners often face unexpected situations that require quick action and a clear understanding of their coverage. Knowing how your policy applies in real-world cases can help you stay prepared and avoid costly surprises.

The questions below provide practical guidance for handling common home insurance claims with confidence.

Will home insurance cover water damage or flooding?

Home insurance usually covers water damage caused by sudden and accidental events, such as burst pipes, appliance leaks, or an overflowing bathtub. However, it does not cover flood damage caused by rising water, heavy rain, or overflowing rivers. For that, you’ll need a separate flood insurance policy, often provided through the National Flood Insurance Program (NFIP) or a private insurer.

Does my policy cover damage from natural disasters like earthquakes or hurricanes?

Standard home insurance policies:

- Do cover damage caused by windstorms and hurricanes, including wind and flying debris.

- Do not cover damage from earthquakes or flooding; you must purchase separate policies for those.

Some insurers may offer optional riders or endorsements to add earthquake or flood protection. Always review your policy or speak with your agent to ensure you’re protected based on your location.

What if my home is damaged by someone else, like a neighbor’s tree falling?

If a neighbor’s tree falls on your property and causes damage, your home insurance policy typically covers the repair costs, regardless of who owns the tree. However, if the tree was dead or neglected and your neighbor was aware of the risk, you may be able to file a liability claim against their insurance for reimbursement. Documentation and photos can help during the claims process.

Am I covered if someone gets injured on my property?

Yes, home insurance includes personal liability coverage, which protects you if someone gets injured on your property due to unsafe conditions, like slipping on an icy walkway or falling down stairs. It can cover:

- Medical expenses

- Legal fees

- Court judgments or settlements

However, it won’t cover intentional harm or injuries to people living in your household.

What happens if I’m a victim of theft or vandalism?

If your home is broken into or vandalized, your home insurance will cover the stolen or damaged property, up to your policy limits. It typically includes:

- Theft of personal belongings (e.g., electronics, jewelry)

- Vandalism to your home’s structure (e.g., broken windows, graffiti)

You’ll need to file a police report and submit proof of loss, like photos and receipts, when making your claim. High-value items may require additional coverage for full reimbursement.

Does home insurance cover damage caused by pets or animals?

Home insurance may cover certain types of animal-related damage, but it depends on the circumstances. If your pet injures a guest or causes damage to someone else’s property, your liability coverage may help cover the costs.

However, most standard policies do not cover damage your pet causes to your own home or belongings. On the other hand, if a wild animal like a raccoon or deer damages your property, some policies may cover the repair, especially if it’s considered sudden and accidental.

Disputes, Denials, and Resolution

Insurance claims don’t always get approved right away, and when they’re delayed or denied, it’s important to know your rights and next steps. Understanding how to challenge a decision or resolve a dispute can make a big difference in the outcome.

The questions below explain how to handle denials, communicate effectively with your insurer, and seek resolution if your claim hits a roadblock.

Why was my home insurance claim denied?

A claim may be denied for several reasons, depending on your policy and the circumstances of the damage. Common reasons include filing for an event that isn’t covered (like flooding without flood insurance), not meeting the deductible, or missing the claim deadline.

Claims may also be denied if the insurer believes the damage was caused by long-term neglect or pre-existing issues. Incomplete documentation or inaccurate details in your claim can also result in denial.

Can I dispute or appeal a denied claim?

Yes, you have the right to dispute a denied claim. Start by reviewing your insurer’s denial letter and your policy documents to understand the exact reason. Then:

- Contact your insurer to request a detailed explanation or clarification.

- Submit additional evidence (photos, invoices, expert assessments) that supports your case.

- File a formal appeal through your insurer’s internal dispute process.

- If necessary, consult a licensed public adjuster or attorney to guide your response.

Insurers are required to review your appeal and provide a written response.

What are my rights under U.S. home insurance laws?

As a U.S. policyholder, you have the right to:

- Receive clear policy terms and disclosures before you buy.

- Be treated fairly and in good faith by your insurer.

- Receive a timely response to claims and inquiries.

- Dispute or appeal a denial.

- File complaints with your state’s insurance department if you believe your rights are violated.

- Work with a public adjuster or attorney during the claims process.

Each state has its own insurance laws and consumer protections, so check with your state’s department for specific regulations.

Can I switch insurers after filing a claim?

Yes, you can switch insurers even after filing or settling a claim. There’s no legal restriction preventing you from changing providers mid-policy, although you should:

- Wait until your claim is fully resolved.

- Avoid lapses in coverage when transitioning.

- Be honest with the new insurer about your claim history.

Note: Switching won’t erase the claim from your insurance record, and it may affect your new premium.

How do multiple claims affect my premiums or coverage?

Filing multiple claims within a short time can lead to:

- Higher premiums due to increased risk in the insurer’s eyes.

- Non-renewal or cancellation of your policy if claims are frequent or costly.

- Limited coverage options or exclusions added in future policies.

Before filing smaller claims, it’s wise to consider whether the cost justifies the long-term impact on your insurance record.

Who can I contact if I feel my claim was handled unfairly?

If you believe your claim wasn’t handled properly, you can:

- Contact your insurance company’s claims manager to escalate the issue.

- File a complaint with your state’s department of insurance. They investigate unfair practices and enforce state laws.

- Consult a licensed public adjuster or attorney for expert help.

- Contact your state’s consumer protection office for additional support.

These steps can help you challenge decisions or seek fair treatment without needing to go to court immediately.

How long do insurers have to respond to my claim or dispute?

Insurers are generally required to acknowledge and respond to claims within 10 to 15 business days, depending on your state. Once all required documents are submitted, most states require insurers to approve or deny the claim and issue payment (if applicable) within 30 to 45 days.

Dispute responses may follow the same timeframe. You can check specific timelines in your state’s insurance code or with the Department of Insurance.

Tips for Smoother Claim Experiences

A well-prepared homeowner can make the claims process faster, easier, and far less stressful. From documenting damage early to keeping your records organized, simple steps can help avoid delays and disputes with your insurer.

The questions below share practical tips to help you file claims more efficiently and get the support you need, when you need it most.

How can I speed up the claims process?

To speed up your claim, focus on being proactive and prepared from the beginning. Report the damage as soon as it happens, and gather all the required evidence before filing. This includes timestamps, repair quotes, and any supporting documentation.

Use your insurer’s app or online portal if available; it often leads to faster submission and status updates. Staying organized and responding promptly to follow-ups will keep your claim moving without unnecessary delays.

What should I avoid doing during a claim review?

During a claim review, avoid withholding information or making assumptions about what’s covered. Don’t discard damaged property before an adjuster sees it unless it poses a safety hazard, and even then, take clear photos first.

Avoid starting repairs without written approval unless it’s an emergency fix. Lastly, never sign off on a settlement too quickly; review the offer carefully or consult someone if it doesn’t align with your expected coverage.

Is it worth hiring a public adjuster?

A public adjuster can be valuable when a claim becomes time-consuming, complicated, or disputed. If you’re dealing with a high-value loss, unclear policy terms, or feel that the insurer’s offer is unfair, a public adjuster can negotiate on your behalf and help document your losses. However, they charge a fee (typically a percentage of the settlement), so it’s best to consider one only when the potential payout increase justifies the cost.

How do I keep good records to support future claims?

Good recordkeeping starts with consistency. Keep a digital folder dedicated to your property where you store receipts, warranties, inspection reports, and contractor invoices. Every time you make a home upgrade or large purchase, scan and upload proof of value.

You can also log maintenance tasks, such as HVAC servicing or roof repairs, to show you’ve taken reasonable care of your property; this often helps validate claims more easily.

Should I bundle home insurance with auto or other policies?

Bundling your home insurance with auto or other policies can make financial and administrative sense. Many insurers offer lower premiums or multi-policy discounts when you bundle, and managing everything under one provider simplifies billing and renewals.

It can also result in stronger customer service continuity. Still, it’s smart to compare the total cost and coverage versus using different insurers to make sure bundling saves you money.

Mastering Your Home Insurance Claims with Confidence

Navigating home insurance claims can be challenging, but understanding the process empowers you to take control. This home insurance FAQ provides clear answers to common questions, helping you confidently manage your coverage, file claims effectively, and address any disputes that arise.

When you grasp what your policy covers and how to act swiftly, you protect your home and secure the support you deserve when it matters most. Being proactive about learning your policy details and keeping thorough documentation can prevent delays and maximize your claim’s success. Ultimately, well-informed homeowners are best equipped to face unexpected events with assurance and resilience.