Bringing a pet into your life means endless love, loyalty, and joy, but it also comes with responsibility.

Just like us, pets can face unexpected health issues, and vet bills often add up quickly. As of 2024, only about 3.9% of U.S. pets are insured. The number is growing, but most owners still pay out of pocket as awareness increases and veterinary costs rise, especially for dogs.

That’s where pet insurance comes in. It helps cover medical costs, allowing you to focus on your pet’s well-being instead of worrying about expenses.

However, with numerous options, terms, and exclusions, it can be confusing. This guide answers the most common questions pet parents have about pet insurance, giving you the clarity and confidence to make the best decision for your furry friend.

1. Coverage & Exclusions

Before choosing a plan, it’s important to understand what pet insurance typically covers and what it doesn’t. Knowing the common inclusions and exclusions helps you avoid surprises and pick a policy that best fits your pet’s needs.

What kinds of illnesses and injuries does pet insurance typically cover?

Most plans cover:

- Unexpected accidents (broken bones, swallowed objects, poisoning).

- Illnesses such as infections, cancer, and diabetes.

- Chronic conditions like allergies or arthritis.

- Prescription medications related to covered conditions.

Routine care (vaccines, checkups, dental cleanings) is usually excluded unless you add a wellness plan.

What does pet insurance usually not cover?

Most policies don’t cover pre-existing conditions, cosmetic procedures, grooming, breeding-related costs, or elective surgeries. Some also exclude dental cleanings, behavioral training, and routine care unless these services are added through a wellness plan. Always read the fine print; what’s excluded can vary widely between providers.

Are wellness visits or routine care included in pet insurance?

Not by default. Standard pet insurance typically covers accidents and illnesses, but not routine care, including vaccines, annual exams, and flea prevention. However, many companies offer optional wellness add-ons for an extra cost. These can help cover preventive care, but they’re separate from core coverage.

Does pet insurance cover prescription medications and follow-up visits?

Yes, most pet insurance plans cover prescription medications and follow-up visits related to a covered condition. However, coverage varies by provider; some may exclude certain long-term meds, brand-name drugs, or limit follow-up visits. Always review your plan’s drug formulary and follow-up policy details to understand caps, exclusions, and reimbursement rates.

Will pet insurance cover alternative treatments, such as acupuncture or physical therapy?

Some providers do, especially under comprehensive plans, but it’s not standard. Coverage for therapies such as acupuncture, hydrotherapy, or rehabilitation is typically listed under “alternative or holistic treatments.” Always check your policy, since some insurers consider them optional extras.

Can I get coverage for pre-existing conditions, or are those always excluded?

Most pet insurance policies do not cover pre-existing conditions, which are any conditions diagnosed or showing symptoms before enrollment. Some companies, however, will cover curable pre-existing conditions (such as ear infections) if your pet remains symptom-free for a specified period, typically 6 to 12 months.

Do all veterinarians accept pet insurance, or are some excluded from coverage?

Unlike human health insurance, pet insurance usually works everywhere. Most policies allow you to visit any licensed veterinarian, specialist, or emergency clinic in the U.S. Some even cover international veterinarians. You’re not restricted to “in-network” providers, which gives pet owners more flexibility.

What’s the difference between accident-only and comprehensive coverage?

Pet insurance plans typically come in two main types, accident-only and comprehensive, each offering different levels of protection and costs.

| Feature | Accident-Only Coverage | Comprehensive (Accident & Illness) Coverage |

| What’s Covered | Injuries from accidents (broken bones, poisoning, swallowed objects). | Accidents plus illnesses (cancer, diabetes, infections, chronic conditions). |

| Cost | Lower monthly premiums | Higher monthly premiums |

| Limitations | No illness coverage; only valid for sudden injuries. | Much broader coverage, but costs more. |

| Best For | Owners on a tight budget want basic protection. | Most pet owners who wish to have complete financial protection. |

Understanding coverage is only half the story. The other concern on every pet parent’s mind is cost: how much insurance really costs each month, and what factors determine those prices.

2. Cost & Financial Considerations

Your pet’s health is important, and unexpected vet bills can be overwhelming. Pet insurance helps cover those costs, giving you peace of mind when your furry friend needs care.

The questions below offer clear, practical answers to help you understand how pet insurance works and what to consider when choosing a plan.

What affects the cost difference between insuring a dog and a cat?

Dogs typically cost more to insure because they are more prone to breed-related health issues and tend to have a higher incidence of accidents. Cats, especially those kept indoors, have fewer high-risk medical needs. Factors like breed, age, and location also influence pricing, no matter which type of pet you have.

What factors affect the price of my premium (breed, age, location)?

Premiums are influenced by:

- Breed – Some breeds are prone to expensive conditions (e.g., hip dysplasia, heart disease).

- Age – Older pets cost more to insure due to higher health risks.

- Location – Vet care is more expensive in certain cities or regions.

- Coverage type – Accident-only vs. comprehensive coverage changes the cost.

- Deductible & reimbursement rate – Lower deductibles and higher reimbursement rates increase monthly premiums.

How do I choose the right deductible and payout amount for my pet insurance?

Choosing the right deductible and payout limit depends on your budget and how much risk you’re willing to take on. A lower deductible means higher monthly premiums but less expense during a claim. A higher deductible reduces premiums but increases out-of-pocket costs when care is needed. Also, check the annual payout cap; higher limits offer better protection for major or repeated issues.

Will I need to pay the bill first and wait for reimbursement, or can the insurance company pay the vet directly?

In most cases, you’ll pay the vet bill first and then submit a claim to your insurer for reimbursement. Some insurers do offer direct-pay to the vet, but this depends on both the provider and whether the clinic supports it. It’s a good idea to ask your vet and insurance company about this ahead of time to avoid surprises.

How long does it typically take to receive reimbursement after filing a claim?

Reimbursement usually takes 5-15 business days once you’ve submitted all required paperwork and vet records. Some insurers with digital claim systems may process payments faster, sometimes within a few days. However, delays can happen if records are missing or additional information is needed, so double-check your submission to speed things up.

How do annual coverage limits work, and how much coverage do most owners need?

Annual limits set the maximum amount your insurer will reimburse in a year. Higher limits offer more protection for serious emergencies, while lower limits result in a lower premium. Select a coverage cap based on your pet’s health risks and the level of financial protection you desire in the event of costly treatments.

Is it smarter to get pet insurance or save money in an emergency fund?

Whether pet insurance or an emergency fund is better depends on your situation. Saving money gives flexibility, but building enough can take time. Insurance provides faster coverage for costly issues like surgeries or chronic care. Many people use both insurance for big surprises and savings for smaller or uncovered expenses to feel fully prepared.

Do premiums increase as my pet gets older?

Yes, premiums usually rise as your pet gets older. This is because older pets are more likely to develop health issues, making them costlier to insure. In many cases, rates can increase sharply after age 7 or 8. Getting coverage while your pet is young can help you avoid higher costs later and keep options open.

Can I customize my plan to fit my budget, or is it a one-size-fits-all approach?

Most insurers let you adjust deductibles, reimbursement rates, and annual limits to control premiums. You can also choose between accident-only or comprehensive coverage. This flexibility helps tailor a plan that matches both your pet’s needs and your budget.

Knowing the costs and options is helpful, but price isn’t the only factor; there are also some drawbacks to pet insurance that every owner should understand before signing up.

3. What to Do When Your Pet Needs Care

When your pet needs care, you don’t want to waste time figuring things out. Learn how to use your policy smoothly, from vet visits to filing claims, so you’re ready when it matters most.

How do I file a claim with my pet insurance provider?

Filing a claim typically involves submitting a claim form, an itemized vet invoice, and sometimes medical records through an online portal, mobile app, or by email. Many providers offer step-by-step instructions. Be sure to file your claim promptly after treatment and track its status to avoid delays.

What documentation is required when submitting a claim?

You’ll need a detailed invoice from your veterinarian showing the services and costs, your completed claim form (which is usually downloadable or digital), and possibly your pet’s medical history or exam notes. Keeping organized vet records helps speed up processing and ensures nothing important is missing from your claim.

What’s the average timeline for pet insurance reimbursement?

Most pet insurance reimbursements take about 5 to 15 business days. Some companies offer quicker payouts through mobile apps or direct deposit. To avoid delays, make sure your claim includes all required documents, like itemized invoices and medical records. A complete and accurate submission helps speed up the process.

Can I track the status of my pet insurance claim?

Yes, most pet insurance companies let you track your claim online or through their app. You can usually view the status, like received, in review, approved, or denied, and check the expected reimbursement. If you’re not getting updates, contact customer support with your claim number for more details.

What happens if my claim is denied? Can I appeal it?

Yes, most insurers allow appeals. You’ll need to review the denial reason, gather any missing documents, and provide a written explanation or ask your vet for additional notes. Submit all necessary documents within the insurer’s appeal window, which typically ranges from 30 to 60 days after the denial.

Do I need pre-approval to have my treatment covered?

In most emergency cases, no pre-approval is required. However, for scheduled procedures or expensive treatments, some insurers offer pre-authorization to confirm coverage in advance. It’s optional but recommended for high-cost care, giving you peace of mind before committing to treatment.

4. Decision-Making & Buyer’s Perspective

Pet insurance should meet both your budget and your pet’s needs. Discover what matters most in a plan and how to pick one that works for you.

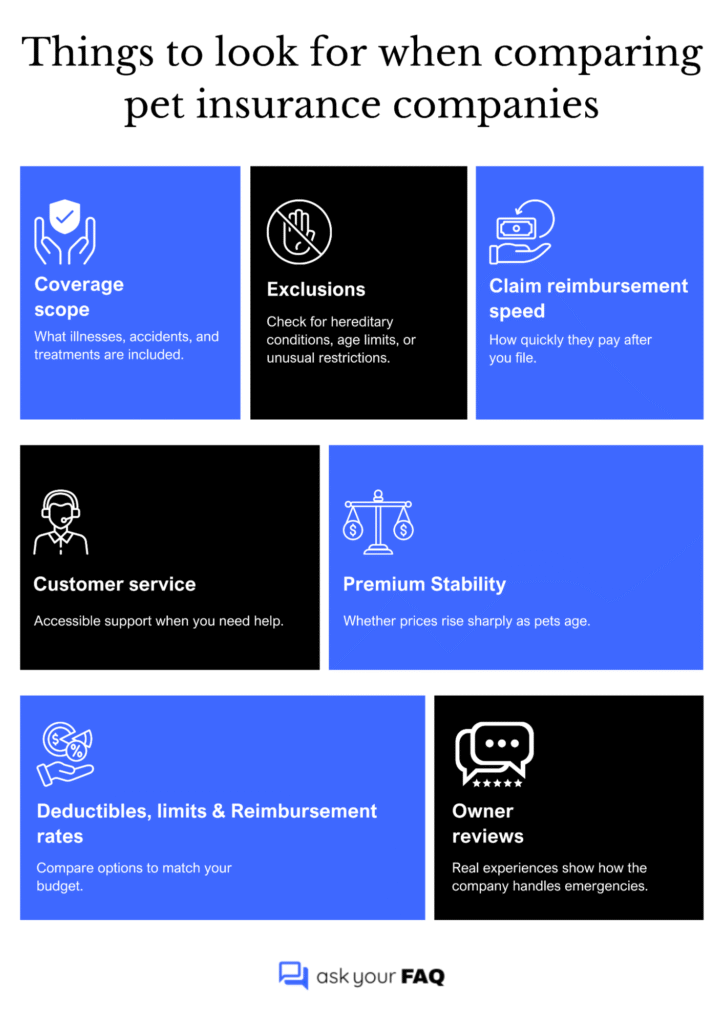

What should I look for when comparing pet insurance companies?

When comparing pet insurance, look beyond price. Check what’s covered and excluded, how fast claims are reimbursed, and whether premiums stay stable over time. Evaluate deductibles, annual limits, and reimbursement rates. Finally, read customer reviews to see how insurers actually support pet owners during emergencies.

Which type of pet insurance coverage is the most practical for the average pet owner?

To help you decide what makes sense for your pet and budget, here’s a quick comparison of the main coverage types:

| Coverage Type | What’s Covered | What’s Not Covered | Cost | Best For |

| Accident-Only | Injuries from accidents: broken bones, poisoning, swallowed objects, and car accidents. | Illnesses (cancer, infections, diabetes), routine care, and hereditary conditions. | Lowest monthly premium. | Owners on a tight budget who want basic emergency protection. |

| Accident & Illness | Everything in accident-only plus illnesses: cancer, infections, diabetes, arthritis, chronic conditions, prescriptions. | Routine wellness care, unless added separately. | Moderate to higher premium. | Most owners who want comprehensive protection against major health costs. |

| Wellness Add-Ons | Routine care: vaccines, checkups, flea/tick prevention, dental cleanings, spay/neuter. | Emergencies, illnesses (covered separately under other plans). | Added a monthly fee on top of the base plan. | Owners who prefer predictable monthly costs instead of paying out of pocket for preventive care. |

Choosing the right coverage comes down to your budget and your pet’s lifestyle. There’s no one-size-fits-all, but understanding the differences helps you make the best call.

How do I know if I’m over-insuring or under-insuring my pet?

If your plan’s annual limit is far higher than typical vet costs in your area, you may be over-insured and overpaying. On the other hand, if your coverage cap is too low to handle surgeries or cancer treatment, you’re under-insured. Match limits to realistic risks and your budget.

What should I look out for in the fine print before buying a plan?

Some important things to check before you commit:

- Breed exclusions – Some plans don’t cover conditions common to specific breeds.

- Waiting periods – Coverage typically doesn’t start immediately.

- Age limits – Older pets might not be eligible for full coverage.

- Specialist care – Not all plans include emergency or specialist visits.

- Premium increases – Prices may rise as your pet gets older.

- Reimbursement rules – Some only pay fixed amounts, not your full vet bill.

Does pet insurance make sense if I have a mixed-breed dog with healthy parents?

Yes. While mixed breeds often face fewer hereditary issues, accidents and unexpected illnesses can still result in expensive veterinary bills. Insurance provides financial protection against unpredictable situations, even if your dog’s genetic risk is lower than average.

When is the best time to buy pet insurance, puppy/kitten stage, or later in life?

Puppy/Kitten:

Buying insurance early offers the lowest premiums, no pre-existing condition exclusions, and the most comprehensive coverage. You’ll pay premiums before major care is likely needed, but it ensures long-term protection and fewer future limitations. This is best for owners who want full peace of mind from the start.

Adult (Middle Age):

Coverage is still widely available and typically more balanced in terms of cost versus need. Premiums are higher than for young pets, and some exclusions may apply if health issues have already been diagnosed. Ideal for those who skipped early coverage but still want to be protected before their senior years.

Senior:

Insurance at this stage can help with expensive age-related conditions and provide peace of mind. However, it’s also the most expensive option, with many exclusions. Some insurers may even restrict new signups based on age. Best suited for owners who want emergency or major illness coverage despite the cost.

5. Alternatives & No-Insurance Scenarios

Not everyone has pet insurance, and that’s okay, but it’s still important to be prepared. Here’s what you can do if an emergency comes up, from savings options to payment plans and where to find help when you need it most.

What are my options if I don’t have pet insurance and face a hefty vet bill?

If you’re facing a hefty vet bill without insurance, there are some ways to get help or manage costs:

- Ask your vet about payment plans – Some clinics offer in-house financing or sliding-scale options.

- Use third-party financing – Tools like CareCredit or Scratchpay allow you to pay over time.

- Reach out to nonprofit organizations – Groups like RedRover Relief and The Pet Fund offer emergency financial aid.

- Check with local animal charities or shelters – They may provide direct help or referrals to low-cost care.

- Try pet-focused crowdfunding – Platforms like GoFundMe are often used to raise funds for urgent treatments.

Do vets offer payment plans or financial assistance for emergencies?

Some veterinarians offer payment plans, but it varies by clinic. Larger veterinary clinics often partner with financing services like Scratchpay or CareCredit, while smaller practices may have their own in-house payment options. It’s a good idea to ask your vet about these options in advance, so you’re prepared if an emergency situation arises.

Is setting aside a savings fund for my pet a better alternative to insurance?

A savings fund works if you’re disciplined and can build it quickly, but it takes time to grow. Insurance, on the other hand, protects you immediately against high-cost emergencies. Many owners combine both a small emergency fund and insurance for the best balance.

What’s the risk of relying only on savings instead of pet insurance?

Relying solely on savings for pet emergencies can be risky. Savings take time to build, and a major emergency, like surgery or long-term treatment, could deplete them quickly. Pet insurance provides immediate coverage for large, unexpected bills, offering a safety net that savings alone may not provide in time, especially for costly procedures.

Will a veterinarian still treat my pet if I am unable to pay up front?

Most veterinarians require payment at the time of service, as they are not legally obligated to provide free care. Some may stabilize your pet or refer you to an emergency clinic offering financing options. However, for ongoing treatment, you’ll generally need to pay upfront or provide proof of financing. Always discuss payment options with your vet before an emergency arises.

Now, let’s examine real-life experiences, including what pet parents and veterinarians think about insurance, as well as the factors that influenced their decisions.

6. Tips to Maximize Your Pet Insurance Benefits

Even after buying a policy, many pet owners don’t know how to get the most out of their coverage. Knowing how to avoid common mistakes and maximize your benefits helps you get the full value from your plan.

How can I make sure my claims are approved quickly?

To help your claims get approved as quickly as possible:

- Submit all required documents (itemized invoices, claim form, medical records) right away.

- Use your insurer’s online portal or app for faster processing.

- Double-check that your vet’s notes clearly match the treatment you’re claiming. Missing or unclear info is the biggest reason for delays.

Are there ways to lower my premiums without losing essential coverage?

Yes, there are smart ways to lower your premiums while still keeping essential protection in place. You can choose a higher deductible if you’re comfortable covering a larger out-of-pocket cost during a claim, opt for an annual rather than per-incident deductible to save more over time, and skip wellness add-ons if you can budget routine care separately.

Focusing your coverage on emergencies and major illnesses ensures you maintain meaningful protection without overpaying each month.

Should I shop around after I buy a policy?

Switching is tricky if your pet develops conditions (they’ll count as pre-existing with a new insurer). Instead of switching often, review your plan annually, adjust deductibles or reimbursement rates if needed, and explore any new benefits, coverage upgrades, or loyalty discounts your current insurer may have introduced.

Do loyalty perks or discounts exist for pet insurance?

Yes, many companies offer various ways to save on pet insurance, such as multi-pet discounts, bundling with your home or auto insurance, loyalty rewards for no-claim years, and even employer-sponsored plans, so it’s worth asking your HR department if this benefit is available. These savings can significantly reduce overall costs and make comprehensive coverage more affordable over time.

How can I prepare my vet for working with my insurance provider?

To make the claims process smoother and avoid delays, it helps to coordinate with your veterinarian in advance:

- Asking if they have experience submitting claims directly, some clinics can handle the paperwork for you.

- Providing them with your insurer’s claim forms or online submission details upfront so everything is ready when needed.

- Confirming they can issue detailed invoices with treatment codes and notes, which helps prevent claim rejections or processing delays.

What’s the best way to handle a big emergency bill, even with insurance?

Because most pet insurance reimburses you after treatment, you’ll likely need to pay upfront. Here are some ways to prepare:

- Apply for CareCredit or other veterinary financing in advance so you’re approved before an emergency happens.

- Ask your insurer about direct-pay options if your veterinarian supports them.

- Maintain a small emergency fund to cover upfront costs while you wait for reimbursement.

Pet Insurance FAQ: Final Takeaways for Pet Parents

Every pet parent wants the same thing: a healthy, happy companion and the confidence to give them the best care possible. Pet insurance isn’t about expecting the worst; it’s about being prepared for the unexpected. Whether you choose a policy, set up a savings fund, or a combination of both, the goal is the same: to protect your pet without sacrificing your peace of mind.

As vet costs continue to rise, exploring your options now means fewer hard choices later. Your pet depends on you, and with the right plan in place, you’ll be ready for whatever comes next.