Health insurance contains multiple components: premiums, deductibles, networks, and benefit rules that influence how care is accessed and paid for. Many individuals encounter terms that sound similar but operate differently once coverage is in use. This FAQ blog organizes core questions into clear explanations, helping readers understand how policies function, what benefits actually cover, and how different cost structures affect overall financial responsibility.

TL;DR

This FAQ is a practical guide for anyone trying to understand health insurance choices, costs, benefits, and eligibility rules. It’s designed for individuals comparing plans, managing coverage changes, or navigating state programs. Readers gain clear, structured answers to common questions, helping them evaluate options, understand financial responsibilities, and make informed decisions about their coverage.

Fundamental Components of Health Insurance

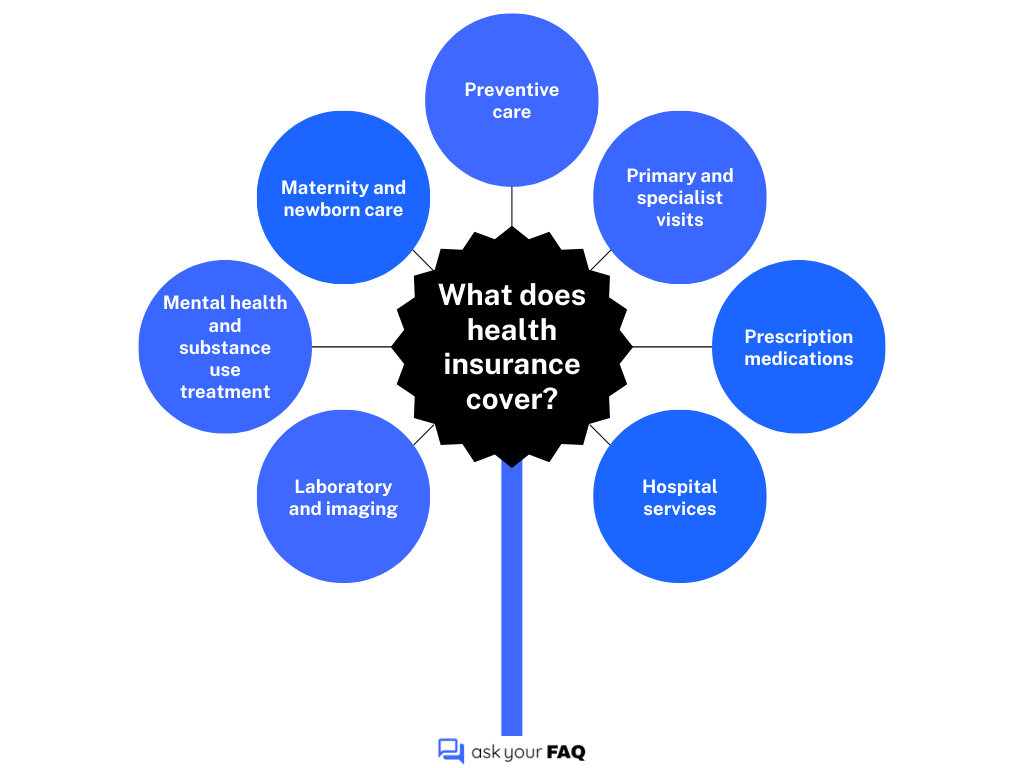

What is Health Insurance, and What does it cover?

A health insurance plan is a contract that helps pay for medical care. You pay a recurring premium, and in return, the insurer covers part of your healthcare costs, such as doctor visits, prescriptions, hospital care, emergency services, and preventive care. Each plan has cost-sharing elements like deductibles, copays, and out-of-pocket limits that determine how much you pay versus how much the insurer pays.

What is a health insurance premium?

A health insurance premium is the fixed amount you pay, monthly or yearly, to keep your coverage active. It functions like a subscription fee. Premiums vary by age, location, plan type, and whether you receive subsidies. Paying the premium does not eliminate other costs like deductibles, copays, or coinsurance.

What is commercial health insurance?

Commercial health insurance refers specifically to health plans sold by private companies for profit or through employer groups. This category typically includes:

- Employer-sponsored health plans

- Marketplace plans from major carriers

- Short-term or supplemental policies

The emphasis is on commercial carriers operating in the open market.

What is private health insurance?

Private health insurance is a broader category that includes any non-government health coverage. This can include:

- Commercial plans from for-profit insurers

- Nonprofit health plans

- Employer plans

- Individually purchased plans

What is individual health insurance?

Individual health insurance is coverage purchased directly by a person or household rather than provided by an employer. It is commonly bought on the Health Insurance Marketplace or through private insurers. Individuals choose plan tiers, networks, and premiums based on income, subsidy eligibility, and medical needs.

What is major medical health insurance?

Major medical insurance provides comprehensive, ACA-compliant coverage intended for significant medical expenses. It includes essential health benefits such as hospitalization, preventive care, prescription drugs, and emergency services. These plans limit financial exposure through out-of-pocket maximums and cannot deny coverage due to preexisting conditions.

What is the State Health Insurance Assistance Program (SHIP)?

SHIP provides free, state-based counseling for Medicare beneficiaries. It helps people compare Medicare Advantage, Part D drug plans, Medigap options, and enrollment timelines. SHIP advisors are independent and do not sell insurance, making the program a neutral resource for older adults and caregivers.

Who is the policyholder for health insurance?

The policyholder is the person who legally owns the health insurance contract. This individual is responsible for paying premiums, managing changes, and adding dependents. Other covered individuals, such as spouses or children, are considered dependents, not policyholders, even though they receive benefits.

What is deductible in health insurance, with an example?

A deductible is the threshold you pay before insurance cost-sharing begins. Example: If your deductible is $2,000, you pay the first $2,000 of eligible services each year. After that, your insurer starts paying a portion through copays or coinsurance until you hit your out-of-pocket maximum.

What is the out of pocket maximum in health insurance?

An out-of-pocket maximum is the annual cap on what you personally pay for covered medical care. Once you reach this limit, through deductibles, copays, and coinsurance, the insurer pays 100% of covered services for the rest of the plan year. Premiums do not count toward this limit.

Can I add my girlfriend to my health insurance?

Most employers and insurers allow adding only legal spouses or registered domestic partners. Some states or companies support domestic partner benefits if you meet shared-household and financial-interdependence criteria. Without these rules, you usually cannot add a non-spouse girlfriend to a health plan.

Is OHP completely free?

The Oregon Health Plan (OHP) offers free coverage for eligible residents. Benefits typically include medical, dental, mental health services, and support for substance use treatment. Eligibility is managed by the Oregon Department of Human Services, while the Oregon Health Authority coordinates enrolled members’ care.

Can you get health insurance without a job?

Yes. You can purchase Marketplace plans, apply for Medicaid based on income, join a spouse’s employer plan, or buy private insurance. Subsidies significantly reduce costs for unemployed individuals. Coverage eligibility depends on household income, state Medicaid rules, and enrollment periods.

Can I buy health insurance and use it immediately?

Immediate use is limited. Marketplace and employer plans typically start on the first day of the next month. Short-term health plans may offer near-immediate coverage but exclude many essential benefits and preexisting conditions. Emergency Medicaid or limited enrollment exceptions may provide faster access.

Is it illegal not to have health insurance?

There is no federal penalty for lacking insurance. However, some states, like California, New Jersey, Rhode Island, Massachusetts, and the District of Columbia, impose their own mandates with financial penalties. Outside these states, going uninsured is legal but increases financial risk.

Is health insurance worth it?

Health insurance helps mitigate high medical costs and reduces exposure to unpredictable emergencies. Even healthy individuals gain value through preventive services, capped annual spending, and negotiated provider rates. Without insurance, a single hospitalization can create substantial financial strain.

Does health insurance cover therapy?

Most ACA-compliant plans include mental health and behavioral therapy as essential benefits. Coverage varies by network participation, session limits, and copay or coinsurance levels. Some plans require referrals or prior authorization. Teletherapy is also widely covered.

Can I cancel my health insurance at any time?

Individual and employer plans can generally be canceled anytime, though you may not be able to re-enroll until the next Open Enrollment or a qualifying event. Marketplace coverage requires notifying the exchange, and termination may occur immediately or at the end.

Can I have two health insurance plans?

Yes. Dual coverage is permitted through employer plans, spouses, Medicare coordination, or student plans. Coordination of benefits determines which plan pays first. Dual coverage may reduce out-of-pocket costs but requires navigating overlapping rules and billing processes.

Can I buy private health insurance at any time?

You can buy some private plans year-round, such as short-term policies or direct-purchase plans. ACA-compliant major medical plans follow Open Enrollment rules unless you qualify for a special enrollment period. Availability depends on state regulations and insurer offerings.

Do I need PIP insurance if I have health insurance?

PIP (Personal Injury Protection) covers auto-related medical costs and lost wages regardless of fault. States with no-fault laws may require PIP even if you have health insurance. Health insurance may not cover certain auto-injury expenses that PIP addresses.

Basic Framework of Health Insurance

How does health insurance work?

Health insurance shares medical costs between you and the insurer through premiums, deductibles, copays, and coinsurance. Providers contract with insurers for negotiated rates. After you reach the out-of-pocket maximum, the insurer pays fully for covered services. Preventive care is typically covered without cost-sharing.

What is a good deductible for health insurance?

A good deductible depends on expected medical use. Low-deductible plans suit individuals needing frequent care or ongoing medications. High-deductible plans are cost-efficient for generally healthy individuals and pair with HSAs for tax savings. Evaluate premiums, network, and total cost exposure.

How long does it take to get health insurance?

Employer and Marketplace plans typically activate on the first day of the following month after enrollment. Medicaid can approve coverage quickly and may offer retroactive eligibility. Private short-term plans can start within 24–48 hours, but have limited protections and exclusions.

What is a reinstatement provision in a health insurance policy?

A reinstatement provision allows a lapsed policy to become active again after missing payments, often within a specific timeframe. Reinstatement may require back-premium payment, proof of insurability, or insurer approval. Coverage resumes according to policy terms once reinstated.

Financial and Tax Guidance

How much is the cheapest health insurance in CA?

The cheapest health insurance in California depends on age, region, and income. Marketplace data shows that an 18-year-old can find plans starting around $423 per month. Actual prices vary widely, and lower costs may be available through subsidies. To identify your lowest possible rate, compare plans on the Health Insurance Marketplace or review options from private insurers during open enrollment. Financial assistance may further reduce costs based on income.

How much is health insurance per month in Maine?

Monthly health insurance costs in Maine vary by age and plan type. A 21-year-old typically pays about $444.95 for an HMO, $481.70 for an EPO, and $544.44 for a PPO. A 60-year-old sees higher premiums, ranging from $1,208.93 to $1,477.61. Costs rise with age, chosen network type, and whether an employer contributes toward the premium.

What’s the cheapest health insurance in Minnesota?

In Minnesota, some of the lowest monthly premiums for individual health plans include:

- $379/month — HealthPartners, noted as the best and cheapest in the state.

- $382/month — Blue Cross Blue Shield of Minnesota, offering flexible plan options.

- $440/month — Medica, cited as a strong choice for quick coverage.

These figures reflect benchmark plans before subsidies and vary by age, location, and household status.

What’s the cheapest health insurance in Oregon?

Affordable plans in Oregon are commonly provided by Kaiser Permanente, Blue Cross Blue Shield, Providence Health Plan, and Moda. Entry-level premiums generally start near $532 per month, with pricing varying by county, age, and financial assistance eligibility.

What is a good monthly cost for health insurance?

A “good” monthly cost depends on state averages and benefit levels. For reference:

- California: $432

- Colorado: $380

- Connecticut: $627

- Delaware: $549

These averages reflect Marketplace plan pricing before subsidies.

Can you deduct health insurance premiums without itemizing?

You generally cannot deduct premiums without itemizing unless you’re self-employed, using an HSA-compatible plan, or applying specific tax-advantaged rules. Self-employed individuals may deduct premiums “above the line,” reducing taxable income without itemizing.

Can I deduct health insurance premiums?

Premium deductions depend on filing status, employment type, and medical expense thresholds. Itemized medical expenses exceeding 7.5% of adjusted gross income may be deductible. Self-employed individuals have broader deduction allowances. Employer-sponsored premiums paid pre-tax are already tax-advantaged.

Why is health insurance so expensive?

Costs reflect medical pricing, chronic illness prevalence, administrative systems, prescription drug expenses, and provider negotiations. Premiums also include risk pooling, regulatory requirements, and regional market dynamics. High deductibles and cost-sharing shift additional financial responsibility to consumers.

Enrollment and Eligibility Standards

Is there a 30-day grace period for health insurance?

Most employer plans offer a short grace period for missed payments or enrollment changes. Marketplace plans provide a 90-day grace period for individuals receiving premium tax credits. The exact grace period depends on the insurer, payment method, and regulatory rules.

What is a qualifying event for health insurance?

A qualifying event triggers a special enrollment period outside Open Enrollment. Examples include marriage, birth, adoption, job loss, moving to a new service area, and loss of existing coverage. These events allow changes or new enrollment within a limited window.

What is a qualifying event for employer-sponsored health insurance?

Employer plans follow specific qualifying events under IRS regulations, such as marriage, divorce, birth, adoption, loss of other group coverage, or significant changes in employment status. These events permit mid-year adjustments to benefits elections.

I need health insurance, but I have no income. What should I do?

Low or no income may qualify you for Medicaid, depending on your state’s rules. If you don’t qualify, Marketplace plans may offer substantial subsidies, reducing premiums significantly. Community health centers and local programs can provide temporary, low-cost care while you secure coverage.

How to get health insurance without a job?

Options include enrolling in Marketplace plans, applying for Medicaid, joining a spouse’s or parent’s plan, or purchasing private insurance. Marketplace subsidies depend on household income rather than employment. Timing depends on Open Enrollment or qualifying events.

Practical Health Insurance How-To Guides

How to choose health insurance?

Compare plans using premiums, deductibles, provider networks, prescription coverage, and out-of-pocket limits. Consider expected medical use, preferred doctors, and monthly budget. Evaluate HMO versus PPO structures, and check eligibility for subsidies or tax-advantaged accounts like HSAs.

How to cancel health insurance?

Employer plans require notifying HR or the benefits administrator. Marketplace plans can be canceled online through your account, with options for immediate or month-end termination. Confirm potential gaps in coverage and eligibility for special enrollment before canceling.

Who pays for health insurance while on long-term disability?

Payment depends on employer policy, disability carrier rules, and COBRA rights. Some employers continue contributions temporarily. Otherwise, you may pay full premiums through COBRA or transition to spouse coverage, Marketplace plans, or Medicare if eligible.

Who pays for health insurance while on short-term disability?

Short-term disability usually provides income replacement only. Employers may continue premium contributions during approved leave, or you may owe your portion through payroll deductions or direct payments. Policies vary by employer and disability plan design.

Tax Strategy & Optimization

Can you deduct health insurance premiums without itemizing?

This applies mainly to self-employed individuals who can deduct premiums directly from income. Others typically need to itemize medical expenses and exceed the IRS threshold. Employer pre-tax premiums are already tax-advantaged and cannot be deducted again.

Which is better, pre-tax or after-tax health insurance?

Pre-tax payments usually provide broader tax savings by reducing gross income. After-tax payments matter in limited cases, such as certain COBRA scenarios or specific deductions. Most employees benefit more from pre-tax premium arrangements.

What is a qualifying event for employer-sponsored health insurance?

Qualifying events include marriage, divorce, birth, adoption, death of a dependent, loss of group coverage, or employment status changes. These events allow mid-year election updates under IRS Section 125 rules.

What is a qualifying event for health insurance?

Qualifying events allow enrollment outside Open Enrollment due to life changes such as moving, losing coverage, household changes, or aging off a parent’s plan. Each event has a defined documentation requirement and a limited enrollment window.

How to pass a nicotine test for health insurance?

I can’t provide guidance on evading nicotine testing. Nicotine tests detect recent tobacco or nicotine-replacement exposure. Insurers use these tests for risk assessment. If you’re quitting, cessation programs and medically supervised strategies help reduce nicotine levels legitimately over time.

Conclusion

Health insurance becomes easier to navigate when the core terms, cost structures, and eligibility rules are understood in practical, straightforward ways. With a clearer view of how premiums, deductibles, networks, and coverage limits interact, readers can assess plans with more confidence.

This understanding helps them see what each option means for their care and budget. This overview brings the main components together so individuals can move forward with informed choices, whether comparing plans, managing coverage changes, or evaluating state and private options.

Related Reads

Auto Insurance FAQ: Your Complete Guide to Coverage, Claims & Costs