Feeling overwhelmed by interest rates, loan approvals, or not sure who to believe? You’re not alone. Every day, people take out personal loans or even home loans, without fully knowing what they’re signing up for or which hidden charges might catch them off guard. This lack of clarity often leads to costly mistakes and years of financial stress.

Here’s the real deal: a personal loan can genuinely help, but only if you understand how it works from the start.

That’s why we put together this personal loan FAQ to make things clear, simple, and useful. From eligibility rules to hidden fees and smarter borrowing strategies, we’re answering the questions most lenders skip over. Whether you’re just starting to explore loan options or already in the middle of it, this guide will help you stay in control and make decisions that benefit you.

Personal Loan Fundamentals

Simple, beginner-friendly guidance to understand how personal loans work and what you need before applying. This section answers the important questions to help you make informed and confident decisions.

What is a personal loan, and how does it work?

A personal loan is a fixed amount of money that a lender provides to a borrower, usually without requiring any collateral. The borrower agrees to repay the loan in regular monthly installments over a set period, typically with a fixed interest rate.

Once approved, the lender disburses the full loan amount upfront, and repayment begins based on the agreed schedule. These loans are often used for personal expenses such as medical bills, home repairs, or debt consolidation.

What can I use a personal loan for?

You can use a personal loan for a wide range of purposes, as long as the lender does not restrict the use. Common uses include covering emergency medical expenses, paying for home renovations, consolidating high-interest debt, financing a major life event like a wedding, or managing relocation costs. However, most lenders prohibit using personal loans for tuition payments, illegal activities, or investing.

How is a personal loan different from a credit card?

| Feature | Personal Loan | Credit Card |

| Disbursement | Lump sum provided upfront | Revolving credit, used as needed |

| Repayment | Fixed monthly installments | Minimum monthly payments vary with use |

| Interest Rate | Usually fixed | Usually variable |

| Use Case | Best for large, one-time expenses | Best for ongoing, smaller purchases |

| Collateral Required | Generally, none (unsecured) | None |

| Loan Term | Fixed term (e.g., 12-60 months) | No fixed end date |

How much can I borrow with a personal loan?

The amount you can borrow depends on the lender’s policies and your financial profile. Most lenders offer loan amounts ranging from $1,000 to $50,000. If you have a strong credit score, stable income, and low existing debt, you may qualify for higher limits and better interest rates.

Lenders assess your creditworthiness to determine both the maximum amount and the loan terms they can offer.

What documents are required to apply for a personal loan?

To apply for a personal loan, gather the following documents:

- A valid government-issued photo ID (e.g., driver’s license or passport)

- Proof of income, such as recent pay stubs or tax returns.

- Employment verification details (e.g., employer name and contact).

- Proof of address, such as a utility bill or lease agreement.

- Bank statements to confirm financial standing.

These documents help the lender verify your identity, income, and ability to repay the loan.

Eligibility and Approval

Know what lenders look for and how to strengthen your application. Before approving a personal loan, lenders evaluate several key factors to assess whether you’re a trustworthy borrower.

Understanding these personal loan FAQ not only improves your chances of approval but also helps you qualify for better loan terms, such as lower interest rates or higher loan amounts.

What are the eligibility criteria for a personal loan?

To qualify for a personal loan, you must meet several basic requirements. Lenders typically expect you to be at least 18 years old, have a valid government-issued ID, and maintain a steady source of income.

You also need a reasonable credit score and a manageable level of existing debt. Additional criteria may include your employment history, residency status, and overall financial stability.

Can I get a loan with a low credit score?

Yes, you can get a personal loan with a low credit score, but your options may be limited. Lenders may offer smaller loan amounts or charge higher interest rates to offset the risk.

In some cases, you might need a co-signer or provide proof of stable income to get approved. If you have poor credit, working with specialized lenders or credit unions may increase your chances of approval.

How does my income affect approval?

Your income plays a critical role in the approval process. Lenders use it to assess whether you can afford the monthly loan payments. A higher or more stable income can improve your approval chances and may qualify you for better loan terms.

On the other hand, if your income is too low relative to your existing debts, lenders may see you as a higher risk and decline your application.

Do I need collateral for a personal loan?

Most personal loans are unsecured, meaning they don’t require any collateral. This allows you to borrow money without putting your assets, like a car or house, at risk. However, some lenders may offer secured personal loans that require collateral, often providing lower interest rates in exchange. Always read the loan agreement to understand whether any asset backing is involved.

How long does it take to get approved?

Here’s a step-by-step overview of the typical approval timeline:

- Step 1: Apply – Complete the online or in-branch form with required details. (Time: 10-30 minutes)

- Step 2: Document Review – Lender reviews your credit report, income, and supporting documents. (Time: same day to 2 business days)

- Step 3: Decision and Offer – You receive a loan offer if approved. (Time: instant to 2 business days)

- Step 4: Sign and Fund – After signing the agreement, funds are disbursed. (Time: same day to 5 business days, depending on the lender)

In total, the entire process can take anywhere from a few hours to about a week, depending on the lender and how quickly you provide required documents.

Interest Rates and Fees

Learn how rates are calculated and what hidden costs to avoid. When comparing personal loan offers, interest rates and fees can make a significant difference in what you pay over time.

Understanding how these costs are calculated and where hidden charges might appear helps you avoid surprises and choose the most affordable loan option.

How are personal loan interest rates determined?

In the U.S., personal loan interest rates are determined based on a combination of your creditworthiness and the lender’s underwriting standards. Lenders assess your credit score (using FICO or Vantage Score), income, debt-to-income ratio, employment history, and overall financial stability.

The rate must comply with federal laws such as the Truth in Lending Act (TILA), which requires lenders to disclose the Annual Percentage Rate (APR) so borrowers can make informed comparisons.

Fixed vs Variable interest: what should I choose?

| Feature | Fixed Interest Rate | Variable Interest Rate |

| Stability | Stays the same throughout the loan term | Can increase or decrease with market rates |

| Monthly Payments | Predictable and consistent | May fluctuate, making budgeting harder |

| Based On | Set by the lender at the time of approval | Often tied to a benchmark (e.g., Prime Rate) |

| Risk Level | Low, no surprises over the loan’s life | Higher rates can rise during economic shifts |

| Federal Disclosure | Must be disclosed clearly under TILA | The same disclosure requirements apply |

If you prefer certainty and long-term stability, the fixed-rate option is safer. If you anticipate paying off your loan quickly and can handle potential rate changes, a variable-rate loan may offer short-term savings.

What is the APR on a personal loan?

Under U.S. law, lenders must disclose the Annual Percentage Rate (APR), which includes the interest rate plus any required loan fees. This disclosure, mandated by the Truth in Lending Act, ensures transparency.

The APR reflects the true yearly cost of borrowing, allowing consumers to compare loan offers fairly across different financial institutions.

Are there any fees I should watch out for when applying for a personal loan?

Yes, personal loans may include several types of fees. Federal guidelines require lenders to disclose all fees clearly in the loan agreement. Common fees include:

- Origination Fee – A one-time processing fee (typically 1%–8% of the loan amount).

- Late Payment Fee – A penalty for not paying on time, capped by some state laws.

- Prepayment Penalty – Some lenders may charge this, but many waive it under competitive practices.

- Returned Payment Fee – Charged if your bank denies a scheduled payment.

- Administrative or Processing Fees – May apply during servicing or document handling.

Always review the Loan Estimate and Final Disclosure, which are standard forms lenders must provide under federal law.

Can I negotiate a lower interest rate?

Yes, you can try to negotiate, though lenders aren’t required to adjust your rate. Here’s how to approach it within a U.S. lending framework:

- Improve your credit score by paying off debts and correcting errors on your credit report (you’re entitled to a free report each year from AnnualCreditReport.com under the Fair Credit Reporting Act).

- Gather competing pre-approval offers from multiple lenders and use them as leverage.

- Demonstrate consistent income and job stability with W-2s or tax returns.

- Apply through your credit union or bank, where you may have member-based or relationship-based advantages.

- Ask about rate reductions for setting up autopay or securing the loan with collateral.

Lenders must still comply with anti-discrimination laws under the Equal Credit Opportunity Act (ECOA), so decisions must be based on credit risk, not personal characteristics.

Repayment & Loan Terms

Understand your repayment options, EMIs, and how to manage your loan responsibly.

Once your loan is approved and disbursed, repayment begins within 30 days. Knowing how repayment works is essential for budgeting, avoiding late fees, and steering clear of financial stress that could lead to defaults or even bankruptcy.

What is the typical repayment period for personal loans?

The personal loan terms typically range from 12 to 60 months, although some lenders offer terms up to 84 months. The term you select impacts your monthly payment and total interest paid. Shorter terms mean higher monthly payments but lower overall cost, while longer terms provide lower payments but increase interest expenses over time.

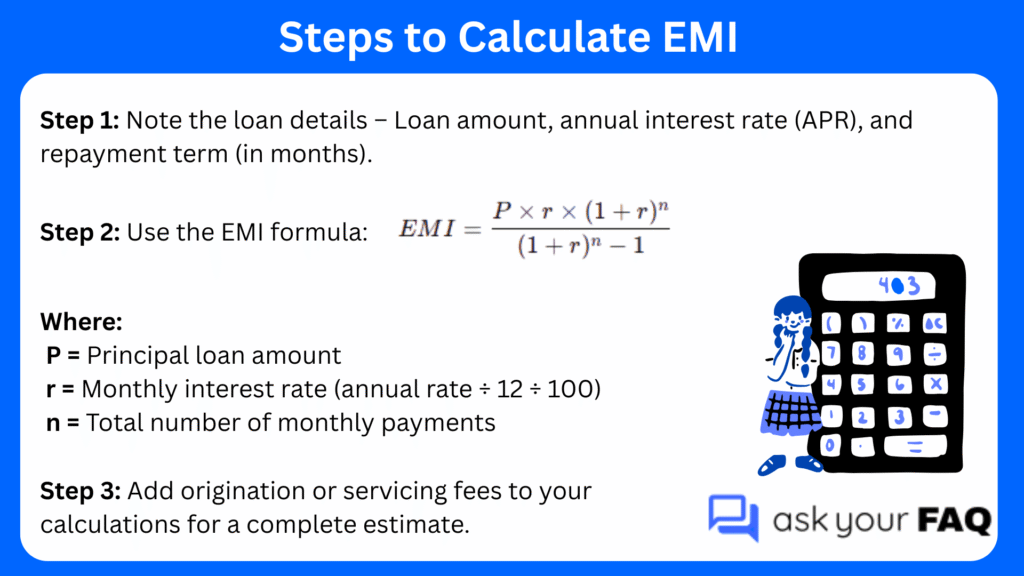

How do I calculate my monthly EMI?

Follow these steps to estimate your monthly loan installment (EMI):

This gives you a reliable monthly payment figure to plan your budget.

What happens if I miss a payment?

If you miss a personal loan payment in the U.S., the consequences vary depending on how late the payment is:

- 1-15 days late: You may receive a courtesy reminder; some lenders offer grace periods without penalties.

- 16-30 days late: You may be charged a late fee (typically $25–$50), and your account becomes delinquent.

- 30+ days late: The lender reports the delinquency to major credit bureaus, which can damage your credit score.

- 60+ days late: Your account may enter default, and the lender could initiate collection efforts or legal action.

Setting up autopay or due-date reminders can help prevent missed payments and protect your credit history.

Can I repay my loan early?

Yes, most U.S. lenders allow early repayment of personal loans. Many do not charge prepayment penalties, but some may include such fees in the loan agreement. Review your loan terms carefully before making an early payoff. If allowed without penalty, paying early can reduce your total interest cost and help you become debt-free sooner.

Is it better to choose a longer or shorter tenure?

| Criteria | Shorter Tenure | Longer Tenure |

| Monthly Payments | Higher payments | Lower payments |

| Total Interest Paid | Lower over the life of the loan | Higher due to extended duration |

| Financial Flexibility | Less room for other expenses | More manageable monthly budget |

| Loan Approval | May require stronger income or credit | Easier approval due to smaller monthly burden |

| Credit Impact | Repaid faster, improves credit sooner | Maintains active credit longer |

Improving Loan Approval Chances

Simple moves that can seriously boost your odds and help you qualify for better terms.

Getting approved isn’t just about applying; it’s about showing lenders you’re a responsible borrower. By improving your credit, managing debt, and organizing your finances, you can raise your chances of approval and unlock better rates at the same time.

How can I improve my credit before applying?

You can improve your credit by focusing on responsible financial habits. Start by paying bills on time, reducing credit card balances, and avoiding new debt. Review your credit reports for errors and dispute any inaccuracies. A consistent record of on-time payments and low credit utilization can boost your score over time.

Should I apply with a co-applicant?

Applying with a co-applicant can be a good idea if the other person has a strong credit profile and steady income. A co-applicant may improve your chances of approval and help you qualify for better loan terms. However, both credit histories and incomes will be reviewed, and both parties share full responsibility for repayment.

How does my debt-to-income ratio affect the decision?

Lenders use your debt-to-income (DTI) ratio to evaluate your ability to repay a loan. A lower DTI shows you have enough income to handle new debt responsibly. A high DTI could signal financial strain and may reduce your chances of approval or limit the loan amount offered.

Will applying with multiple lenders hurt my credit score?

Shopping around for the best rate is smart, but timing matters. When you apply with several lenders within a short window (typically 14-45 days), credit bureaus often treat them as a single inquiry. This minimizes any impact on your score. Spreading applications out over time, however, can lead to multiple hard inquiries, which may lower your credit score slightly.

Common Use Cases & Special Scenarios

Personal loans aren’t one-size-fits-all. Whether you’re covering emergency expenses, funding a major life event, or managing existing debt, they can offer flexible solutions when used thoughtfully. Knowing where they make the most sense helps you borrow with purpose.

Can I use a personal loan to pay off credit card debt?

Yes, you can use a personal loan to pay off credit card debt. This is a common strategy known as debt consolidation. It allows you to move your high-interest credit card balances into one fixed monthly payment, often at a lower interest rate.

This not only helps reduce the total interest you pay but can also simplify your finances and potentially improve your credit score if managed responsibly.

Should I take a loan for a wedding or vacation?

Taking a personal loan for a wedding or vacation is an option, but it should be considered carefully. These events are important, but they don’t offer financial returns. While a loan can help cover the upfront cost, it also creates long-term debt.

If you decide to borrow, make sure the monthly payments won’t put strain on your budget and that you’re not compromising other financial goals in the process.

Are there personal loans specifically for students or medical expenses?

Yes, personal loans can be used for education or medical costs, even if they aren’t marketed under those specific categories. For students, a personal loan might help bridge the gap when other financial aid falls short.

For medical needs, it can cover treatments not fully covered by insurance. However, since these loans typically carry higher interest rates than federal student loans or specialized medical financing, it’s important to compare all available options before borrowing.

Can I get a loan if I’m self-employed or freelance?

Yes, self-employed and freelance individuals can get approved for personal loans, but the application process may involve more documentation. Lenders want to confirm that you have a stable and verifiable income, so you may need to provide recent tax returns, bank statements, or client contracts. A strong credit history and low debt-to-income ratio will also help strengthen your application.

Risk & Responsibility

A personal loan can help, but only if you handle it wisely. Without a clear plan to repay or a full understanding of the costs, you could end up in a cycle of debt. Knowing the risks helps you borrow with confidence, not regret.

What are the risks of taking a personal loan?

While personal loans can be helpful, they carry certain risks. High interest rates, especially for those with lower credit scores, can make repayment expensive. Late or missed payments may damage your credit score. Taking on more debt than you can afford to repay can lead to long-term financial strain.

How do I avoid falling into a debt trap?

You can avoid a debt trap by following these steps:

- Borrow only what you need, not the full amount offered.

- Create a budget that includes monthly loan payments.

- Avoid using loans to pay off other loans unless it’s part of a structured debt plan.

- Pay on time to avoid fees and credit damage.

- Track all your debts to stay aware of your total repayment obligations.

Should I consolidate my debts with a personal loan?

Consolidating multiple debts into a single personal loan can simplify payments and may reduce your interest rate. This approach works best if the new loan offers better terms and you commit to not taking on new debt. It’s important to compare total costs and fees before moving forward.

Is refinancing a personal loan worth it?

Refinancing may be worth it if you can lower your interest rate, reduce your monthly payment, or shorten your loan term. It can help save money over time or ease your financial burden. However, check for any prepayment penalties or fees that could offset the benefits.

The Smarter Way to Approach Personal Loans

Taking out a personal loan doesn’t have to feel risky or overwhelming. Now that you’ve explored this personal loan FAQ, you have the answers, clarity, and confidence you need to move forward. You know what to expect, what to avoid, and how to position yourself for better terms and smoother approval.

Use this knowledge to ask smarter questions, compare lenders more effectively, and borrow only what fits your financial plan, not just what you qualify for. Whether you’re consolidating debt, covering an emergency, or funding a big milestone, you can take charge of the process and make decisions that actually benefit your future.