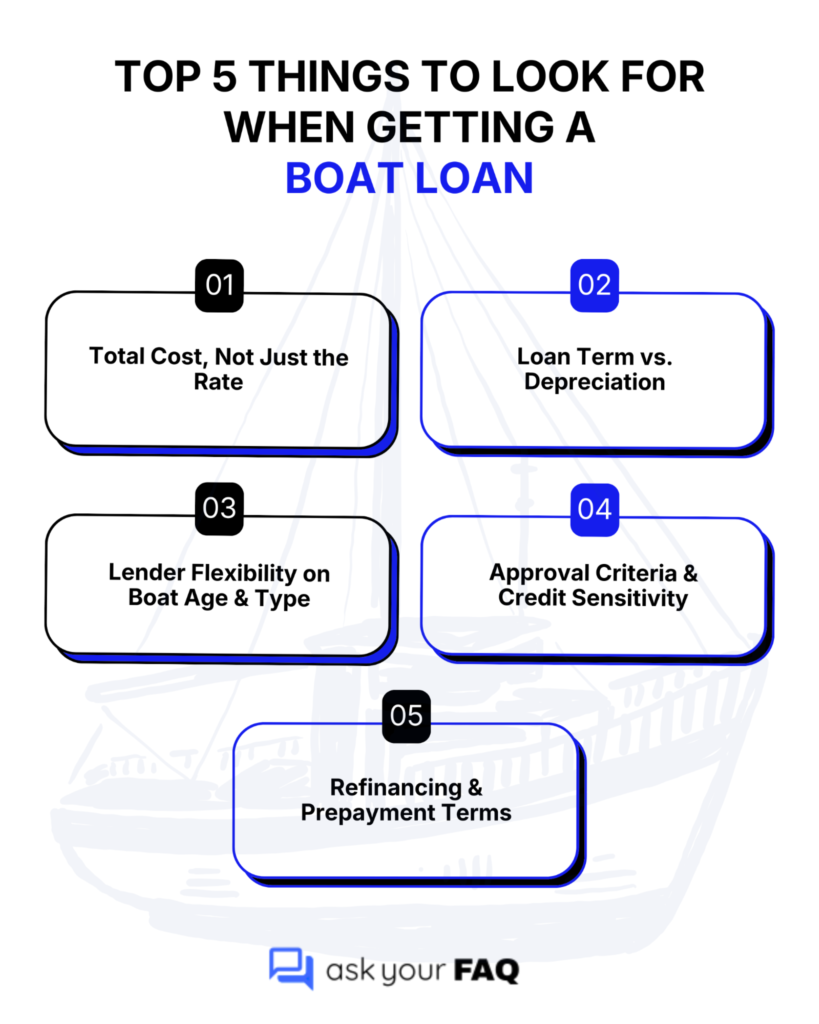

Boat loans can make boat ownership possible, but before you apply, it helps to understand how boat financing works, what lenders evaluate, and how payments align with your long-term budget. Rates, terms, and approvals can vary based on your credit profile and the vessel itself.

Knowing the key factors upfront makes it easier to compare offers and avoid surprises. With guidance from trusted resources and lenders like Curis Financial, you can move forward with clear expectations and stronger decision-making.

Summary

- Cost: Boat loan pricing varies widely. Rates are driven mainly by credit profile, down payment, loan term, and vessel age/type/condition (collateral value).

- Terms: Loan structures differ by lender. Typical variables include term length, APR, fees, and whether the lender offers pre-approval, fixed rates, or refinancing options.

- Approval: Underwriting is based on borrower strength (income, DTI, credit history) and boat details (value, title status, survey/inspection requirements).

- Common pitfalls: Monthly-payment comparisons, long terms that increase total interest, and overlooking eligibility limits for older or specialty vessels.

How to get a boat loan?

Getting a boat loan is easier when you break it into clear steps. First, review your finances, check your credit score, calculate your debt-to-income ratio, and decide on a realistic down payment while factoring in ownership costs. Next, gather key documents like income proof and boat details. Then, compare lenders and get prequalified to review rates without impacting your credit. Finally, submit a full application, complete any required inspections, and close the loan.

How does a boat loan work?

A boat loan finances a watercraft through a secured installment loan. In most cases, the boat acts as collateral, so the lender can repossess it if you don’t repay the loan. You make fixed monthly payments over a set term, and each payment goes toward both principal and interest. Lenders set the rate, term, and down payment requirements based on their guidelines, your credit profile, and the boat’s value, age, and type.

Can you get a loan to buy a boat?

Yes, you can finance a boat through banks, credit unions, marine lenders, or dealerships. Most boat financing uses secured loans, where the boat acts as collateral, which helps keep rates lower. Terms commonly range from 10 to 20 years, and loans are available for both new and used boats. Lenders typically review your credit and income. Comparing lenders and getting pre-approved can help you find terms that fit your budget.

Where to get a boat loan?

You can obtain a boat loan from several sources, each with its own unique strengths. Credit unions often offer lower rates and fees for members. Specialty marine lenders focus on boats and may allow longer terms or older vessels. Banks work well for borrowers with strong credit. Online lenders offer fast, digital applications, while dealership financing adds convenience. Comparing multiple lenders helps you find the best mix of rate, flexibility, and service.

Who has the best boat loan rates?

There isn’t one single lender that has the best boat loan rates for everyone. Rates depend on your credit score, loan term, boat type, and down payment. Credit unions often offer some of the lowest rates for members, while specialty marine lenders are competitive and more flexible with boat age and size. Online lenders can be fast, but they may charge higher fees. The best way to find your lowest rate is to compare personalized quotes from several lenders.

Do I qualify for a boat loan?

Yes, getting approved for a boat loan is possible if your finances are in good shape. Lenders typically look for a credit score around 670 or higher, steady income, and a manageable debt-to-income ratio (usually under 40%). A 10–20% down payment can improve approval odds, especially for used or higher-priced boats. Newer boats are easier to finance, but marine lenders may offer options for older vessels or lower credit scores.

How to get pre-approved for a boat loan?

Getting pre-approved for a boat loan means a lender has reviewed your credit and finances and given you a conditional loan amount. This helps you shop with a clear budget and move quickly when you find the right boat. To get pre-approved, check your credit, gather income documents, decide on a down payment, and apply with a few lenders. Pre-approval can improve negotiating power and make the buying process smoother.

Is it easy to get a boat loan?

Getting a boat loan isn’t especially hard if you’re well prepared, but it can be more selective than a car loan. Lenders usually look for credit scores around 680+, steady income, and a low debt-to-income ratio. Newer boats in good condition are easier to finance. Borrowers with lower credit can still qualify, though often with higher rates or higher upfront costs. Preparation and comparison shopping make the process much smoother.

What credit score do you need for a boat loan?

Most lenders look for a credit score between 600 and 680 to approve a boat loan, with scores above 700 qualifying for the best rates and terms. That said, approval isn’t based on credit score alone. Lenders also review your income, debt-to-income ratio, down payment, and the boat’s age and value. Borrowers with lower scores may still qualify, but usually with higher interest rates or a larger down payment.

Can I get a boat loan with a 700 credit score?

Yes, a 700 credit score is generally enough to qualify for a boat loan. Most lenders consider this good credit and often offer competitive interest rates and standard loan terms. Approval will still depend on your income, debt-to-income ratio, and a down payment. A clean payment history and low credit utilization can further improve your offer. Comparing lenders and getting pre-approved can help you secure the best terms available.

How to get a boat loan with good credit?

Getting a boat loan with good credit is mostly about preparation and comparison. Start by confirming your credit score (670+ helps, 700+ is ideal) and setting a realistic budget that includes ownership costs. Gather basic documents like income proof and boat details. Then compare offers from marine lenders, credit unions, banks, and online lenders. Getting pre-approved lets you review rates and terms upfront. With good credit, you’ll usually qualify for better APRs, longer terms, and more flexibility.

How to get a boat loan with bad credit?

Yes, it’s possible to get a boat loan with bad credit, though it usually comes with higher interest rates and stricter terms. Many borrowers improve their chances by offering a larger down payment (often 20% or more), applying with a co-signer, or working with specialized marine lenders. Showing stable income and choosing a less expensive or newer boat can also help. Pre-qualifying with multiple lenders lets you explore options without hurting your credit.

What is a typical boat loan interest rate / APR?

Boat loan APRs typically fall between 6% and 10%, though the exact rate depends on your situation. Borrowers with excellent credit may see rates in the high-5% to low-6% range, especially for newer boats. With average credit, rates often land around 7–9%. Older boats or lower credit scores can push rates into the 10–15%+ range. Your credit score, loan term, down payment, and the boat’s age all play a major role, so comparing lenders is key.

What is the average boat loan interest rate?

Average boat loan rates typically fall between 7% and 10% APR. Borrowers with excellent credit (760+) may find rates starting around 6–7%, especially for newer boats or larger loan amounts. Those with average credit often see rates closer to 7.25–9%, while lower credit or smaller loans can push rates above 9–10%. Your credit score, boat age, loan term, and down payment all influence the final rate, so comparing lenders is essential.

What are current boat loan rates / rates right now?

Current boat loan rates typically range from about 6% to 10%+ APR, depending on your profile. Borrowers with excellent credit (760+) may see rates in the 6–7% range, especially for newer boats or larger loans. Those with good credit (700s) often land around 7.5–9%, while older boats or lower credit can push rates higher. Rates vary by lender, loan term, and boat age, so comparing personalized quotes is the best way to find your true rate.

What is a good interest rate / good APR for a boat loan?

A good interest rate (APR) for a boat loan reflects strong credit and favorable market conditions while keeping your total cost reasonable. As of late 2025:

- Excellent credit (740 +): Around 6%–7.5% APR is typically considered good.

- Good credit (680–739): Around 7%–9% APR is solid.

- Below good credit: Higher APRs (9% +) may still be workable, but are not considered “good.”

Why this matters:

- Lower APRs mean less interest paid over time.

- Terms, boat age, and lender type also affect what’s “good” for you.

How long is a typical boat loan term?

A typical boat loan term usually falls between 10 and 20 years. Smaller boats and personal watercraft often have shorter terms, around 2 to 7 years, while mid-size boats commonly land in the 10–15 year range. Larger or more expensive boats, such as cruisers or yachts, may qualify for terms up to 20 years. Longer terms lower monthly payments, but they also increase the total interest paid over time, so balancing affordability and cost is important.

How long can you finance a boat loan for?

You can usually finance a boat for 5 to 20 years, depending on the lender, boat type, and your financial profile. Many buyers choose 10 to 15 years, which balances affordable monthly payments with reasonable total interest. Smaller or less expensive boats often come with shorter terms, while larger, higher-value boats may qualify for longer financing. Keep in mind, longer terms lower monthly payments but increase the total interest you’ll pay over time.

Can you get a 20-year boat loan?

Yes, 20-year boat loans are available, especially for newer or higher-value boats. Many marine lenders and credit unions offer terms up to 240 months to keep monthly payments manageable. These longer terms are most common for larger boats and borrowers with strong credit and steady income. The trade-off is a higher total interest over time and slower equity buildup. A 20-year term can help with affordability, but it’s worth comparing shorter options if your budget allows.

What’s the longest loan term for a boat loan?

The longest standard boat loan term is usually 20 years (240 months). This option is most common for larger or higher-value boats, such as cruisers or yachts, where lenders want to keep monthly payments affordable. Smaller boats and personal watercraft typically qualify for much shorter terms. Your maximum term depends on the boat’s age and value, your credit score, and whether the loan is secured. Longer terms lower payments but increase total interest paid.

What is the average boat loan term / average length?

The average boat loan term typically falls between 10 and 20 years, with 10–15 years being the most common choice for mid- to large-size boats. Smaller boats or personal watercraft often have shorter terms, usually 2–7 years. Loan length depends on factors like the boat’s price and age, your credit profile, and whether the loan is secured. Longer terms lower monthly payments, but they increase the total interest paid over time.

How many years is a boat loan?

Boat loan terms usually range from 5 to 20 years, with 10–15 years being the most common. Smaller or less expensive boats often qualify for shorter terms, while larger, higher-value boats, such as cruisers or yachts, may be eligible for up to 20 years. The right term depends on the boat’s price, your credit profile, and the lender. Shorter terms cost less in interest overall, while longer terms lower monthly payments but increase total interest.

Can I refinance a boat loan?

Yes, you can refinance a boat loan, and it can be a smart move if your credit score has improved or interest rates have dropped. Refinancing may lower your APR, reduce your monthly payments, or adjust your loan term. Lenders typically want to see equity in the boat and a history of on-time payments, often at least 6 months. Before refinancing, check for prepayment penalties and compare fees to be sure the savings outweigh the costs.

How to refinance a boat loan?

Refinancing a boat loan involves replacing your existing loan with a new one that offers better terms. The process is usually straightforward and similar to applying for a new boat loan.

Steps to refinance a boat loan:

- Check your credit score and financial health

- Review your current loan balance, rate, and any prepayment penalties

- Estimate your boat’s current market value

- Decide your goal (lower rate, lower payment, or shorter term)

- Compare offers from banks, credit unions, and marine lenders

- Apply, review the new terms, and close the loan

- Update the boat title and insurance with the new lender

Refinancing can help reduce interest costs or monthly payments if the numbers work in your favor.

How soon can you refinance a boat loan?

You can often refinance a boat loan within a few months, but the exact timing depends on the lender and your financial situation. Many lenders require a short “seasoning period” to show on-time payment history, while others allow refinancing sooner.

What to expect:

- 3–6 months: Common requirement to demonstrate consistent payments

- No waiting period: Some lenders allow immediate refinancing

- Longer minimums: Certain programs may require 12 months

Refinancing makes the most sense if rates drop, your credit improves, or you want better terms. Always check for prepayment penalties before moving forward.

Can you get a boat loan for a used boat?

Yes, financing a used boat is very common, and the process is similar to buying a new one. Many banks, credit unions, and marine lenders offer used-boat loans. Lenders typically look at your credit score, income, and debt, along with the boat’s age and condition, often preferring boats under 10–20 years old. You may need up to a 20% down payment, and a marine survey is sometimes required. Comparing lenders helps you secure the best terms.

How to get a loan for a used boat?

A used boat loan works much like an auto loan. The lender provides funds to purchase the boat, and the boat usually serves as collateral. Loan terms commonly range from 10 to 15 years, sometimes up to 20 years for larger amounts. Approval and rates depend on your credit score, income, and the boat’s age and condition. Older boats may require a marine survey. Getting pre-approved helps set your budget and negotiate confidently.

How to get a boat loan for a private seller?

You can finance a boat from a private seller by working with a marine lender, bank, credit union, or personal loan provider. Start by getting pre-approved so you know your budget. Once you choose the boat, the lender will review details like the HIN, price, and condition, and may require a marine survey. Funds are usually paid via a lender-issued check or escrow service, along with a proper bill of sale and title transfer.

Can I use my boat as collateral for a loan?

Yes, you can use a boat as collateral for a secured loan, and this is very common. In a typical boat loan, the lender places a lien on the boat’s title until the loan is repaid. Using collateral usually means lower interest rates and longer terms compared to unsecured loans. If you already own a boat outright, some lenders also offer boat title loans. Keep in mind, if you miss payments, the lender can repossess the boat.

Can you get a title loan on a boat?

Yes, you can get a boat title loan if you own the boat outright, but it’s generally a high-risk option. These loans use your boat as collateral and often don’t require a credit check, making them fast to access. However, they usually come with very high APRs and fees and short repayment periods. If you can’t repay, the lender can take the boat. Safer alternatives include traditional secured boat loans or personal loans with lower costs.

How old can a boat be to get a loan?

Most lenders will finance boats that are up to 15–20 years old, though this varies by lender and boat condition. Specialized marine lenders are often more flexible and may finance boats 20–30 years old if they’re well-maintained. Older boats usually require a marine survey, a larger down payment (often 20%+), and shorter loan terms. Strong credit and a clean survey significantly improve approval chances for older vessels.

How to sell a boat with a loan?

Selling a boat with an existing loan is possible, but it requires coordinating with your lender. First, request a payoff amount from the lender. During the sale, the buyer’s funds are typically used to pay off the loan directly, clearing the lien. Once paid, the lender releases the title, allowing ownership to transfer. Many sellers use a marine broker or title service to handle funds, paperwork, and lien release smoothly and securely.

Final Thoughts on Boat Loan Decisions

Boat loans are shaped by a combination of borrower strength, vessel characteristics, and lender-specific risk models rather than a single fixed standard. Rates, terms, approval thresholds, and refinancing opportunities all vary based on how these factors interact at the time of application.

Approaching financing with a clear understanding of credit impact, collateral value, and long-term cost trade-offs allows for better alignment between loan structure and ownership goals. Careful comparison and timing remain central to navigating marine lending effectively.

Related Reads

Car Loans FAQ: How to Apply, Manage, Refinance & Pay Off Smartly