Buying a home can feel like a maze. Between the countless loan options, varying interest rates, and complex terms, it’s easy to get lost. The biggest mistake I see is overcomplicating the decision. Too many buyers focus on the wrong factors or jump in without a solid understanding of their financial standing.

Here comes the reality: the right home loan is about more than just getting approved. It’s about finding the best fit for your specific needs, lifestyle, and long-term goals. From FHA to conventional loans, each option comes with its own set of pros and cons.

In this post, we’ll break down the key loan options, what to look for in each, and how to avoid common pitfalls. I’ll also share a simple framework to assess your situation and make the decision clearer.

Home Loan Basics (For Beginners)

From evaluating your eligibility to comparing lenders, knowing what to expect can streamline the process and help you make informed decisions at each stage.

Let’s dive into the details.

How do home loans work?

A home loan, or mortgage, allows you to borrow money to purchase a property, which you then repay over time, typically 15 to 30 years, with interest. The home itself acts as collateral, meaning if you fail to make payments, the lender can repossess the property through foreclosure.

What are the factors I should consider when choosing a home loan?

When choosing a home loan, consider:

- Interest Rates: Fixed or variable rates affect your monthly payments and long-term costs.

- Loan Term: Shorter terms (e.g., 15 years) have higher monthly payments but lower total interest, while longer terms (e.g., 30 years) spread payments out and increase total interest.

- Down Payment: Larger down payments lower the loan amount and may reduce interest rates.

- Fees & Charges: Look for hidden costs like processing fees, insurance, and penalties for early repayment.

- Lender Reputation: Ensure the lender has good customer service and transparent terms.

Also Read: Life Insurance FAQ: Answers the Questions for First-Time Buyers

How do I apply for a home loan?

To apply for a home loan:

- Check Your Eligibility: Ensure you meet the financial requirements (e.g., credit score, income).

- Gather Documents: Include income proof, tax returns, bank statements, and identification.

- Compare Lenders: Shop around for the best rates and loan terms.

- Submit Application: Apply to the chosen lender, submit documents, and wait for approval.

- Approval & Closing: If approved, sign the loan agreement and pay closing costs before receiving the loan.

What are the documents required for a home loan application?

You’ll need:

- Proof of Identity: Government-issued ID.

- Income Proof: Recent pay stubs, tax returns, or bank statements.

- Credit Report: Lenders check your credit score.

- Property Details: Purchase agreement, appraisal, or title information if available.

- Other Financial Documents: Information about your debts and savings.

What is the difference between a home loan and a mortgage loan?

A home loan refers to the borrowed amount for buying a house, whereas a mortgage loan is a legal agreement where the house acts as collateral for the loan. Essentially, all mortgages are home loans, but not all home loans are mortgages in some cases.

What is the process of applying for a home loan?

The process of a home loan application includes:

- Pre-approval: Get a rough idea of how much you can borrow by submitting basic information to a lender.

- Application: Submit detailed financial information, including income and assets.

- Approval & Underwriting: The lender evaluates your financials, conducts an appraisal, and decides on your eligibility.

- Closing: After approval, sign the loan agreement, pay closing costs, and take possession of the home.

How can I improve my chances of getting approved for a home loan?

To improve your chances of securing a home loan:

- Maintain a Good Credit Score: Aim for a score of 620 or higher for better rates.

- Reduce Debt: Lower your debt-to-income ratio to show you’re financially responsible.

- Provide Stable Income Proof: Lenders look for stable and sufficient income to cover loan payments.

- Save for a Larger Down Payment: A higher down payment reduces the lender’s risk and could secure better terms.

- Avoid New Debt: Don’t open new credit accounts before applying for a loan.

Understanding Mortgage Rates

Understanding how mortgage rates impact your loan is essential for making the right decision. It’s important to grasp the difference between interest rates, APR, and the potential benefits or drawbacks of locking in your rate.

Let’s break down these key aspects to give you a clearer picture of how they affect your home loan.

How does the interest rate affect my mortgage?

The interest rate directly affects both your monthly mortgage payment and the total amount you will repay over the life of the loan.

A higher rate results in higher interest costs and a more expensive loan overall. A lower rate reduces your monthly payments and saves you money in the long term.

Even a small change in rate, such as 0.50%, can cost or save you tens of thousands of dollars over a 30-year mortgage.

What’s the difference between the interest rate and APR?

The interest rate is the cost of borrowing money, expressed as a percentage. It does not include lender fees or closing costs.

The APR (Annual Percentage Rate) includes the interest rate plus most fees associated with the loan, such as origination fees and discount points.

APR gives you a more complete picture of the total cost of the loan, which makes it a better tool when comparing loan offers.

Should I lock in my mortgage rate or choose a variable rate?

A fixed-rate mortgage is a good choice if you want stable monthly payments and expect to stay in the home for a long time. Your interest rate and payment will not change over the life of the loan.

A variable or adjustable rate mortgage (ARM) usually offers a lower initial rate but can adjust over time. This option may make sense if you plan to move or refinance before the rate changes.

For most buyers, a fixed rate provides peace of mind and better predictability.

What is a good mortgage rate in 2025?

As of 2025, well-qualified borrowers can typically expect mortgage rates between 5% and 6% for a 30-year fixed loan.

Your actual rate will depend on your credit score, loan amount, down payment, debt-to-income ratio, and the lender you choose. Market conditions also play a role.

Instead of chasing the “ideal” rate, focus on improving your credit and comparing personalized offers from multiple lenders.

How can I compare mortgage rates from different lenders?

Start by requesting Loan Estimates from at least three different lenders. These standardized documents show the interest rate, APR, monthly payment, and total closing costs.

Make sure you are comparing similar loan types and terms. Focus on the APR to compare the true cost of the loan and look at how fees and closing costs vary.

Working with a mortgage broker can also help streamline the process, especially if you’re comparing multiple loan types.

Does a larger down payment help me get a better interest rate?

Yes. A larger down payment reduces the lender’s risk and can lead to a lower interest rate, better terms, and more negotiating power.

If you put down 20% or more, you can also avoid private mortgage insurance (PMI), which can significantly reduce your monthly payment.

Lenders view borrowers with more equity in the home as lower risk, which often results in more favorable offers.

What are the tax benefits of taking out a mortgage?

Homeowners in the U.S. may qualify for tax benefits such as:

- Mortgage Interest Deduction: You can deduct interest paid on up to $750,000 of mortgage debt for a primary or secondary home.

- Property Tax Deduction: You may also deduct up to $10,000 in combined state and local property and income taxes.

Keep in mind that these deductions apply only if you itemize your taxes. It’s wise to consult a tax advisor to understand how these benefits apply to your specific situation.

Loan Tenure and Repayment Terms

Choosing the right loan tenure and repayment terms can have a significant impact on your overall financial health. The key is finding a balance between manageable monthly payments and the total cost of the loan.

What is the ideal loan tenure for a mortgage?

It depends on your goal:

- If you want to be debt-free faster and save big on interest, go with 15–20 years.

- If you need lower monthly payments or plan to reinvest the difference elsewhere, 25–30 years makes sense.

Don’t just pick a term based on EMI. Choose based on the long-term impact on your finances and how long you plan to keep the loan.

15-year vs. 30-year mortgage – what’s the smart choice?

- 15-Year: Costs more monthly but saves you lakhs in interest. Great if your income is stable and you’re focused on faster ownership.

- 30-Year: Easier on cash flow. Ideal if you’re buying your first home, have other investments, or prefer flexibility.

Pro Tip: Choose 30 years, but prepay strategically, you get flexibility and interest savings.

What happens if I pay off my mortgage early?

You’ll stop paying interest and fully own your home. That’s a win.

| But before you jump in | When an early payoff makes sense |

| Check for penalties. Some lenders charge 1–2% for early closure. Ask what you’re giving up. If that money could earn more elsewhere (e.g., business, investments), paying off early might cost you an opportunity. | You’re close to retirement and want zero liabilities. You’ve already covered investments and emergencies. You value peace of mind over higher returns. |

How do I calculate my mortgage payments?

You don’t need to do the math manually.

Use your lender’s online EMI calculator. It’s designed to factor in interest rate, loan tenure, and even applicable taxes. These tools are fast, accurate, and easy to use.

Instead of crunching numbers, focus on the bigger picture:

- Can you sustain the EMI long-term?

- Will you still have room to save, invest, or handle emergencies?

The real goal isn’t the lowest EMI; it’s long-term financial comfort.

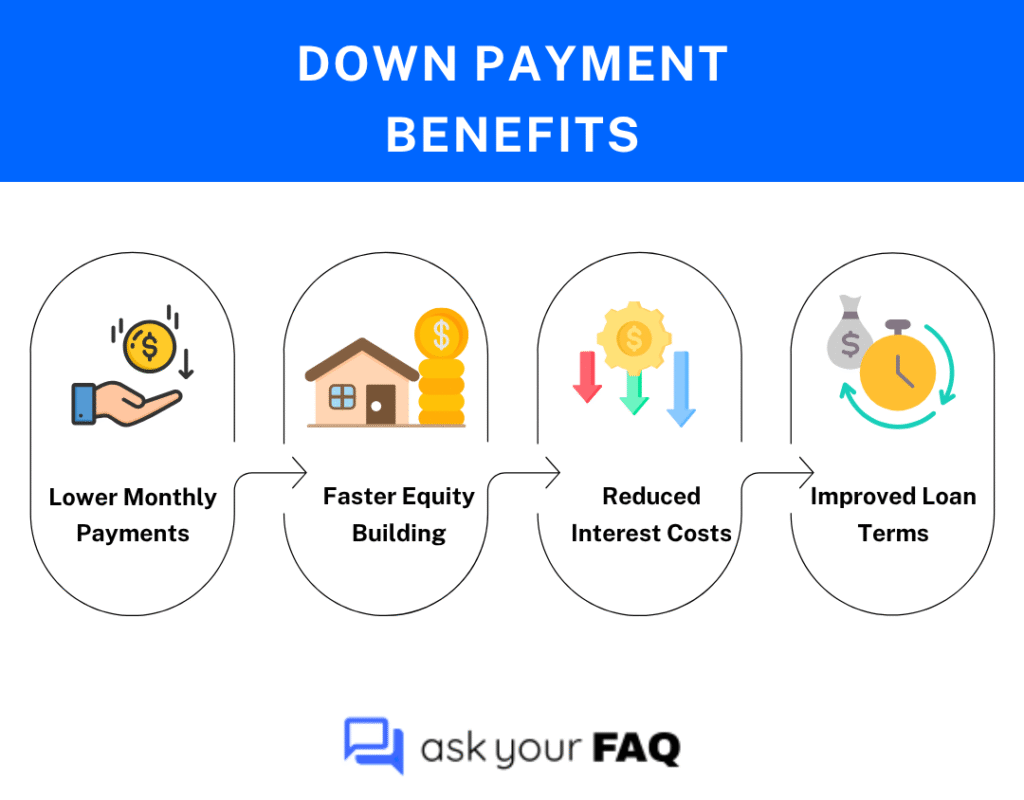

A larger down payment can significantly enhance your home loan experience. Key benefits include:

Fixed vs. adjustable rate mortgage – which is better?

Fixed Rate Mortgage:

- EMI stays constant for the life of the loan.

- Best for long-term homeownership or if you value stability.

- No surprises, ideal in rising interest rate environments.

Adjustable Rate Mortgage (ARM):

- Lower interest rate in the beginning.

- Risk of future rate hikes and rising EMIs.

- Makes sense only if you’re sure you’ll sell or refinance before the rate adjusts.

Simple advice: If you hate uncertainty or plan to stay in the home long-term, go fixed. For short-term stays or refinancing plans, ARM might save you money, but only if you time it well.

Should I choose a longer loan term to lower my EMI?

Yes, if affordability is an issue. Longer tenure = lower monthly payments. That’s useful if your current income is tight.

But there’s a catch:

- You’ll pay much more total interest over time.

- It stretches your debt burden across years.

Start with a longer tenure to keep things flexible, then make early part payments when possible. This reduces your interest and shortens the loan without stress.

How does the Loan-to-Value (LTV) ratio affect my deal?

LTV = Loan Amount ÷ Property Value

- Lower LTV (larger down payment):

- Better interest rates.

- No need for private mortgage insurance.

- More negotiating power with lenders.

- Better interest rates.

- Higher LTV (smaller down payment):

- Higher interest.

- May require mortgage insurance.

- Lender views it as a higher risk.

- Higher interest.

Want better loan terms? Increase your down payment or negotiate a lower purchase price.

What are mortgage points, and are they worth it?

Mortgage points = Upfront fees you pay to lower your interest rate (1 point = 1% of the loan amount).

- Worth it only if you keep the loan for 4+ years.

- Not worth it if you’ll sell or refinance soon.

Rule of thumb:

- Think long-term? → Consider buying points.

- Think short-term? → Save the cash.

Government-Backed Loans and Programs

Government-backed loans offer unique advantages for certain borrowers, providing access to homeownership with less stringent requirements. These loans are designed to support individuals with specific needs or financial situations.

Let’s look at how these loans work and the benefits they offer for qualified applicants.

What is an FHA loan and who qualifies for it?

An FHA loan is a mortgage insured by the Federal Housing Administration, designed for borrowers with lower credit scores or limited savings for a down payment.

Eligibility:

- Credit Score:

- 580 or higher: 3.5% down payment.

- 500-579: 10% down payment.

- DTI: Up to 43% typically allowed.

- Employment: Steady income and employment history required.

- Occupancy: Only for primary residences.

- MIP: Mortgage insurance premiums apply for the life of the loan.

What are the benefits of a VA loan for veterans?

A VA loan is backed by the U.S. Department of Veterans Affairs and is available to veterans, active-duty military, and eligible surviving spouses.

Benefits:

- No Down Payment: No down payment required.

- No PMI: No private mortgage insurance.

- Lower Interest Rates: Typically lower rates than conventional loans.

- No Prepayment Penalties: Pay off the loan early without fees.

- Flexible Credit: No specific credit score requirement, but 620+ is common.

Eligibility: Active-duty members, veterans, and some surviving spouses.

3. How do USDA loans work, and am I eligible for one?

A USDA loan is a mortgage offered by the U.S. Department of Agriculture, designed to encourage homeownership in rural areas by offering low-interest loans with no down payment.

How It Works:

- No Down Payment: 100% financing available.

- Loan Terms: 30-year fixed rates, low interest.

- Mortgage Insurance: Both upfront and annual premiums.

Eligibility:

- Location: Must be in a USDA-designated rural area.

- Income: Household income must not exceed 115% of the area’s median income.

- Credit: Generally 640+ credit score is required.

Can I use my 401(k) for a down payment on a home?

Yes, it’s possible to use funds from a 401(k) for a down payment, but the method used to access the funds impacts the costs and terms.

Options:

- 401(k) Loan: Borrow up to 50% of your balance, repaid with interest within 5 years.

- Hardship Withdrawal: Available for first-time homebuyers, but taxes and penalties apply if under 59½.

- Roth IRA: First-time buyers can withdraw up to $10,000 tax and penalty-free for a home.

Risks: Reduces retirement savings; possible tax penalties.

What are the income requirements for a government-backed loan?

Government-backed loans have varying income requirements:

- FHA Loans: No income limits, but lenders assess repayment ability.

- VA Loans: No income limits, but a residual income requirement applies.

- USDA Loans: Income must not exceed 115% of the area’s median income.

Can I get a home loan with bad credit?

Yes, FHA, VA, and USDA loans allow home loans with lower credit scores:

- FHA: 500+ score with 10% down; 580+ with 3.5% down.

- VA: No official score requirement, but 620+ is common.

- USDA: Typically requires a 640+ credit score.

How do first-time homebuyer programs work?

First-time homebuyer programs offer benefits like down payment assistance and lower interest rates to help people buy their first home.

Common features:

- Down Payment Assistance: Grants or low-interest loans for down payments.

- Lower Interest Rates: Some programs offer competitive rates.

- Tax Benefits: Possible tax deductions or credits.

- Eligibility: Income limits and other criteria apply.

Do I need a co-signer for a home loan if I have no credit?

A co-signer with good credit can help you qualify for a loan if you have no credit.

Considerations:

- Co-signer’s Responsibility: They’re responsible for repayment if you default.

- Impact on the co-signer: Their credit is affected by the mortgage.

Home Loan FAQ: Your Guide to Making the Right Choice

Finding the right home loan doesn’t have to be a headache. With a solid understanding of rates, tenure, and terms, you’re in a much better position to make a smart choice.

By addressing common questions about how rates impact your budget, how loan tenure affects your costs, and what terms you should really care about, you now have the tools to avoid the usual mistakes many people make when shopping for a loan.

Now, it’s time to put all this knowledge into action. Look at your financial picture, figure out what loan option fits best, and move forward with confidence.